Capital Controls as Migrant Controls

The disparate treatment of capital and labor reflects one of globalization’s central asymmetries: the law often allows financial capital, but not people, to move freely across borders. Yet scholars have largely neglected the intersection of these two regimes, the legal restrictions on migrants’ capital, particularly when the migrants themselves are deemed illegal. These restrictions on migrants’ capital abound even while migratory capital generally faces few such restrictions. As such, capital controls may operate as migrant controls.

This Article canvasses established and emerging examples of capital controls as migrant controls and the pressing legal questions these controls raise. Capital is guarded when remittances are taxed, particularly when the taxation is explicitly conditioned on immigration status. Capital is expelled when capital receipts, such as Social Security benefits, are made contingent on departure and non-residency. And capital is marginalized when financial laws require particular identity and immigration documents on penalty of exclusion from key financial services.

As I describe, such taxation, receipt contingencies, and identity requirements often distinguish on the basis of immigration status and implicate core questions in constitutional and immigration law. These questions include the scope of traditional state powers such as taxation; how such controls create unconstitutional choices and conditions; and how statutory and administrative ambiguities in banking law may marginalize migrants. More generally, these controls contribute to our understanding of who—Congress, federal agencies, municipalities and states, or social movements outside the law—controls, and who may legally control, American migration.

Table of Contents Show

Introduction

Sovereign borders are of two minds: welcoming to capital but often hostile to humanity.[2] Capital markets reflect globalization more fully than labor markets.[3] Even when separating allies, friendly nations, and trading partners, borders are still heavily militarized.[4] Due in part to these movement restrictions, only a small percentage of the world’s population appears to live in countries where they were not born.[5] The hindered mobility of people contributes to significant income and other economic inequalities.[6]

In the twenty-first century, capital, particularly in the form of currency and liquid assets, moves more freely, if not completely unrestrained, across borders.[7] Limits that exist on the movement of funds are generally called capital controls.[8] Often focused on international movements of funds, these controls include taxes on remittances and taxes on capital inflows and outflows, as well as direct regulation or full-fledged prohibition of funds’ transfer.[9] For many years, the financial regulation literature focused on how the removal of capital controls—or “financial liberalization”—may spur development.[10] The discourse diversified amidst the financial crises of the late twentieth and early twenty-first centuries.[11] Prominent economists argue for stronger financial borders, even citing John Maynard Keynes.[12] Such economists argue that whatever the domestic financial sector’s problems, the flows of capital from abroad may worsen the problem.[13] Others use “national security” concerns to justify some contemporary American controls.[14] These scholars have moved beyond asking if capital controls should be used, to how capital controls are, and should be, used.[15]

Protectionist impulses notwithstanding, capital controls have broadly receded over the preceding decades, leading scholars to criticize the asymmetry between human and capital movement. For example, Nobel Laureate Gary Becker argued for liberalized immigration so that “the legal movement of human capital across borders would begin to resemble more the movements of goods, services and physical and financial capital.”[16] Legal scholars and political scientists have echoed the call to relax migration restrictions.[17]

Research on capital controls often overlooks how controls target particular communities.[18] “Capital controls” usually refers to broad-based measures centered on asset classes and time periods, particularly surrounding economic crises.[19] But ordinary people crossing borders also accumulate capital, whether that crossing occurs lawfully or unlawfully. Immigration scholars have examined how law distinguishes between migrants with and without capital through admission and public benefits restrictions, but they have somewhat neglected the law’s disparate treatment of migrant wealth and the institutions responsible for creating and enforcing such laws.[20] This critique joins those of other consumer scholars who have noted the unique importance of poor and marginalized communities’ financial activities, which often differ from those used by wealthier people.[21] While individual immigrants’ remittances, bank accounts, and Social Security entitlements may seem modest, collectively, immigrants have substantial financial activity.[22]

This Article furthers a new perspective on capital controls: rather than operating orthogonally to migrant controls, capital controls often operate as migrant controls. What might it look like for capital controls to be migrant controls, and what are the legal consequences? This Article answers both questions by canvasing various examples and then explaining the legal issues that arise.

This Article focuses on three particular capital controls that may act as migrant controls. First, remittance taxation guards capital. State legislatures and the federal government have taxed or are proposing to tax wire transfers, based in part on cross-border destinations and the immigration status of the sender. Second, the government’s refusal to pay Social Security benefits to entitled, but undocumented, immigrants in the United States expels capital.[23] Since otherwise entitled immigrants must leave the United States (without necessarily having to, or being capable of, returning to countries of origin) to collect their earned Social Security benefits, the law expels this capital, making the immigrants’ receipt contingent on departure. Third, and lastly, immigrants lacking particular forms of lawful status have their capital marginalized from the formal financial system. Federal law increasingly compels institutions—most significantly, insured depository institutions—to “identify” their customers, while leaving the parameters of identification intentionally vague. Bank practices diverge, and while municipalities have asked federal regulators to declare certain identifications legally sufficient, regulators have resisted these entreaties and emphasized how banks must make holistic determinations.

Thus, as immigration authorities seek to guard against, expel, and marginalize various migrants, private and public authorities subject migrants’ capital to similar treatment. The significance of these capital controls varies—from the arguably incidental effects of remittance taxes to the fundamental requirement that migrants leave the United States to receive the Social Security benefits to which they are lawfully entitled.[24]

If capital controls are migrant controls, this Article explores how they implicate the constitutional law pertaining to immigration and foreign affairs, including federalism, separation of powers, and various deference doctrines.[25] Aside from constitutional concerns, immigration statutes may also restrict the administration of capital controls. More generally, scrutinizing these capital controls contributes to understanding who—Congress, federal agencies, municipalities and states, or social movements outside the law—controls, and who may legally control, migration.[26]

I begin by briefly situating my attention to capital controls, and their relationship to migrant controls, in Part I. I then describe each capital control in turn: in Part II, the guarding of capital through remittance taxation; in Part III, the expulsion of capital through overlooked Social Security entitlement and payment provisions; and finally, in Part IV, the marginalization of migrants’ capital through the nexus of two antiterrorism statutes: the PATRIOT and REAL ID Acts. I then raise and address the significant legal questions raised by each of these capital and migrant controls in Part V.

I. Why “Capital Controls”? Why “Migrant Controls”?

This Article consciously uses the labels “capital controls” and “migrant controls” to identify the ways that migrants—and their migration—can be controlled by regulating a migrant’s access to their own money. These labels are necessarily imprecise, but that imprecision illustrates the interlocking nature of the policies described below. By distinguishing noncitizens’ money, the law instructs them that they “may be members of a relevant community they share with citizens . . . . [b]ut there are different levels of membership.”[27] Noncitizens, and their money, often occupy a less-favored tier.

First, to address the use of “capital controls.” Some of the regulations that I describe as capital controls, such as restrictions on remittances, are widely recognized as such. Restricting transfer of one’s money—including when based on immigration status—seems to be a quintessential capital control. Other examples, such as limitations on Social Security payments, may be more disputed. The line between capital controls and restrictions on economic benefits is hardly neat. One might think of the question of eligibility as one of access to an economic benefit, yet payment limitations are a different issue. Once someone is eligible for a stream of payments, restrictions on those payments are better understood as capital controls. Payment limitations can be seen as diminishing the economic substance of the benefit. For example, a Social Security benefit that has complicated restrictions on payment is worse than a benefit without such restrictions. My language of choice, however, is "capital controls.”

What of “migrant controls?” Why not “migration” controls? This label acknowledges how the expansion of enforcement and surveillance has led to the “detachment of migration borders from territorial borders.”[28] The controls described below affect the actions of migrants—sometimes but not always leading to migration, whether international or even interstate.[29] As such, this Article builds on the literature recognizing the ways that limitations on immigrants’ economic and social lives, including employment, education, and financial activities, can affect what overstretched border patrol officers may not.[30] As one incisive commentator has articulated, the term “self-deportation” is an “oxymoron[],” reflecting “a variety of state-sponsored coercive removal that assigns some agency to individuals in their own departure,” and one with a long history of controlling the “undesired.”[31] Regulations on migrants’ capital may help states “screen out undesired types so that only desired types will be” welcome and comfortable.[32] This Article questions the extent to which the law allows the screening of capital’s desirability to reflect the desirability of the migrant behind that capital.

To this end, I seek to be descriptive rather than normative in my contribution. First, immigration federalism means American states and municipalities divergently choose a menu of local laws that define “desirable” differently.[33] Within these local laws and their federal interface, this Article moves the conversation of desirability towards capital. Even if American “powerholders [are not] content to receive anyone who want[s] to immigrate,” capital controls may answer the question of whom they wish to receive by asking whose money they wish to receive.[34] Yet states’ ability to use capital controls may be limited by federal law. Whether by digging deep into the technicalities of various state and federal remittance taxation proposals and the attendant foreign affairs preemption and Commerce Clause issues, or by looking at how federal law addresses localities’ attempts to facilitate private banking access through the issuance of local identification, this Article synthesizes capital controls to expose how, and which, migrants are deemed “desirable.”

Second, an accounting of federal law and local efforts in capital controls allows us to think about their connection, intended and practical, to migrants’ economic lives, since the strength of the connection informs their legality. In response to the account that “immigration controls have helped to create a large undocumented labor force subject to economic exploitation,”[35] this Article intervenes by adding another dimension to the shaping of migrants’ economic lives, beyond simply economic benefits. It points to three forms of capital control that affect (not only) the undocumented and chronicles how those controls operate differently across time and space and analyzes whether they operate legally. The extent to which capital controls are migrant controls—and this Article will explore the spectrum—informs the legal analysis itself. Many of these capital controls operate more subtly than better-studied employment and housing restrictions. Yet, as I hope to show, they are substantial in their own right.

II. Guarding Capital: Remittance Taxation

American remittances have long built global financial bridges.[36] This Part historicizes these remittances and their regulation before honing in on emerging state and federal remittance taxation. These laws and proposals vary in four notable ways: (1) the types of capital flows they cover, particularly in terms of destination-restrictions; (2) the ability for individuals to recover the remittance tax through credits; (3) the types of individual taxed and eligible for such credits; and (4) what the remittance taxes fund. As remittance taxes attempt to distinguish capital based on a sender’s immigration status or an international destination, they control the capital of immigrants—including potentially migrant citizens—distinctly from non-migrant citizens who may have little reason to send money abroad. A remittance tax guards capital by taxing the flow of capital from the United States to other countries.

A. The Remittance Market

The history of remittances has long involved migrants sending back financial support. Centuries ago, remittances fueled the United Kingdom’s colonial project, as inbound remittances from America and beyond strengthened the British crown.[37] American colonial remittances evolved from supporting British imperialism to supporting the downtrodden in other parts of the United Kingdom, namely Ireland’s impoverished in the wake of the Great Famine.[38] These pre-World War I capital flows were necessarily primitive, often arriving as “pocket” and “envelope” transfers.[39] European nations relied on these capital inflows, predating the many poor, non-European countries now reliant on them.[40]

Remittances are individually small-scale financial flows, but collectively, ties that bind the world.[41] The United States currently generates the most outward remittance flows of any country, amounting to tens of billions of dollars annually.[42] Remittances act as insurance, potentially “smooth[ing] the incomes of families and shield[ing] policy makers from the vagaries of the global economy.”[43] In countries including Haiti, El Salvador, and Honduras, incoming remittances are substantial when measured as a share of GDP.[44] In light of the substantial role of remittances in emerging economies, the United Nations has taken the position that reducing the transaction costs of migrant remittances by 3 percent globally will help with the United Nations Sustainable Development goal for 2030.[45] The international community has thus argued for strengthening the financial ties of remittances by decreasing their costs.

Those costs arise in a powerful industry dedicated to moving money, largely composed of money transmitter organizations (MTOs) that are not insured depository institutions.[46] MTOs are disproportionately used by those who, like immigrants, might be marginalized from traditional, insured depository institutions like banks and credit unions.[47] At the front of the modern MTO crowd stands Western Union. Once a nineteenth-century telegraph behemoth, Western Union’s modern “vision is to be a global leader in cross-currency, cross-border money movement.”[48] As one periodical put it: “emigrés, expatriates, immigrants, and refugees—the uprooted—are Western Union’s people, and right now we’re living in Western Union’s world.”[49] This characterization offers a financial spin on Edward Said’s 1984 declaration of “the age of the refugee, the displaced person, [and] mass immigration.”[50] Through MTOs, the remittance industry intermediates migrants’ financial lives, particularly noncitizens.[51]

MTOs are regulated at both the federal and state level, with federal regulation expanding since the financial crisis.[52] The Dodd-Frank Wall Street Reform and Consumer Protection Act (hereinafter Dodd-Frank) changed American consumer finance law, including for remittance transfers.[53] Dodd-Frank granted the Consumer Financial Protection Bureau (CFPB) authority to regulate “remittance transfers,”[54] which include electronic transfers of funds[55] abroad initiated by American consumers “primarily for personal, family, or household purposes.”[56] Pursuant to its Dodd-Frank authority, the CFPB issued new regulations governing remittance transfers[57] requiring disclosures of fees, the relevant exchange rate, and the date of availability for the remitted funds.[58] The CFPB’s remittance rule assessment report highlighted Western Union’s “immense global scope and large market share.”[59]

Remittances have persisted for centuries but have also evolved, as evidenced by fledgling blockchain-based remittance services.[60] While popular payment applications like Venmo require U.S. presence, blockchain-based remittance services often do not.[61] End-to-end payment systems like Western Union also face challenges from competitors who directly match buyers and sellers of different currencies without relying on third-party bank currency exchangers.[62] Remittance taxation may influence the demand for particular remittance facilitators but it is unlikely to significantly ebb the demand for remittances.[63]

B. Remittance Taxation

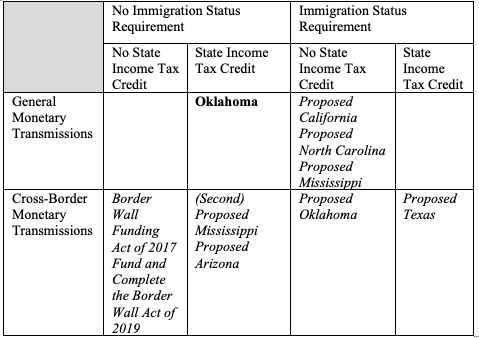

Congress and state legislators have considered taxing remittances, though Oklahoma is the first, and currently only, state with a so-called “remittance” tax.[64] Accordingly, Oklahoma’s law serves as a useful comparator for other proposals. Since 2009, Oklahoma has required that a state-licensed money transmitter collect from the sender a five-dollar fee for any transaction up to $500, and 1 percent of the amount in excess of $500.[65] Banks and credit unions are not state-licensed money transmitters and are therefore exempt from the remittance tax law.[66]

There are four notable features of Oklahoma’s tax. First, the law applies to even those financial flows that do not cross international borders.[67] Second, Oklahoma allows for potential recovery of the remittance tax through the state income tax filing process. While the MTO must collect the tax, the Oklahoma law allows for senders who are state tax filers to claim an income tax credit equal to the remittance tax paid.[68] Third, since the credit is available to filers with either a Social Security Number (SSN) or an Individual Tax Identification (ITIN), it does not facially discriminate based on immigration status.[69] However, very few people appear to claim the offsetting tax credit,[70] allowing Oklahoma to raise over $13 million annually.[71] Fourth, and finally, this revenue is allocated for a Drug Money Laundering and Wire Transmitter Revolving Fund, nominally distinct from immigration enforcement.[72]

Nonetheless, industry lobbyists and foreign sovereigns have looked beyond Oklahoma’s remittance tax as a purported anti-money laundering (AML) capital control and perceived it as a migrant control. The drafter of the Oklahoma tax defended the law by explaining that it “burdens mostly illegal immigrants and drug traffickers from Mexico who wire illegal proceeds back to their home country,”[73] even as American citizens appear to have accrued the majority of federal convictions for drug trafficking.[74] Accordingly, the National Money Transmitters Association publicly wrote that “the Oklahoma government is using us to further their (anti-) immigration agenda.”[75] Ildefonso Guajardo Villarreal, who served as Mexico’s Secretario de Economia (Secretary of the Economy), called the Oklahoma remittance tax “discriminatory and immoral.”[76]

More stringent state proposals have percolated in Oklahoma and beyond. While Oklahoma’s current remittance tax does not explicitly discriminate based on immigration status, a state senate bill was introduced to amend Oklahoma law by imposing an additional tax on “international wire transaction[s] for persons that do not present valid personal identification,”[77] with such “valid” identification seemingly restricted to immigrants with lawful presence.[78] The North Carolina legislature introduced the “Tax on Illegal Immigrant Wire Transfer,” which would impose a 5 percent tax on any wire transfers—not simply out-of-country remittances—made by “unauthorized aliens” as defined in federal law.[79] A year later, the Mississippi Senate introduced the “Illegal Immigrant Fee Act,” which also would charge a 5 percent tax on any wire transmission unless the sender could provide “adequate proof that the customer is legally present in the United States.”[80]

Some state proposals have focused on international transmissions. In 2014, Mississippi tried again by mirroring an earlier Arizona proposal, both of which combined the offsetting income tax credit from Oklahoma law with a focus on international remittances.[81] Texas went one step further beyond a cross-border transmission focus—it conditioned the eligibility of the tax offset on lawful presence.[82] Under these proposals, taxing the cross-border flow of unlawful migrants’ capital is intended to control the cross-border flow of people.[83]

Even “sanctuary” states like California have proposed capital flow taxes levied exclusively against undocumented immigrants, but to unique ends.[84] A California Senate Bill proposed a 3 percent “fee” on “transmission money received from a customer who is unable to provide documentation of lawful presence in the United States.”[85] Yet, California’s proceeds from the fee would not go towards fence building, but rather towards emergency medical care for undocumented immigrants.[86] Unlike other states, California’s undocumented young adults may qualify for the state Medicaid program if otherwise eligible.[87] As such, California envisions a type of fiscal citizenship for those without legal citizenship.[88] Remittance taxes here would have acted as a targeted consumption tax to partly fund health benefits for the taxed community.[89] Accordingly, the remittance tax might comport with “sanctuary” policies and deepen conflicts with federal efforts to disincentivize, rather than to promote, public health care benefits for immigrants.[90]

Federal remittance taxation proposals have also surfaced, including proposals that condition remittance taxes on immigration status. None of the federal proposals I mention include a federal tax offset that would mirror Oklahoma’s. The 2015 Remittance Status Verification Act (RSVA) proposed amending the Electronic Fund Transfers Act, a significant federal money transfer law, and instituting a fine of 7 percent for remittance senders who failed to present acceptable documentation of immigration status.[91] The RSVA would have delegated authority to the Consumer Financial Protection Bureau to identify what documentation would suffice to avoid the fine.[92] The matricula consular, a sovereign-issued consular document common among the Mexican diaspora, was singled out for potential exclusion.[93] While the RSVA never passed, it exposed Congressional efforts to restrict the remittance services available to Mexican nationals by disempowering Mexican identification.[94] More generally, the RSVA tax would have imposed taxes on the capital flows of undocumented immigrants.[95]

Sponsors have explicitly characterized federal proposals with destination-contingent remittance taxes as immigration enforcement tools. While President Trump proposed requiring “lawful presence” to send remittances,[96] Republican members of Congress introduced the Border Wall Funding Act of 2017 (BWFA). This act requires a remittance transfer provider to collect a “remittance fee” equal to two percent of the value of the remittance if the remittance’s designated recipient is located in certain countries, including Mexico and many Central American countries.[97] Mexico receives the greatest value of American remittances, but the destination country list excluded India, China, and Vietnam, which collectively receive more money than Mexico.[98] A few years after the BWFA, Republican members introduced the Fund and Complete the Border Wall Act, which revived the remittance fee but made two critical changes: it raised the fee to 5 percent and extended the fee to any country.[99] These federal proposals focus on international transactions and lack Oklahoma’s offsetting income tax credit, furthering the sense of immigration enforcement. The state and federal proposals and laws are summarized below.

Table 1: Remittance Taxation Proposals and Laws [100][101][102][103][104][105][106][107][108]

Reactions to remittance taxation echo sentiments about immigration enforcement. Proponents of heightened immigration enforcement have commended the “symmetry in having illegal immigrants underwrite part of the enforcement to prevent illegal immigration.”[109] To be clear, this “symmetry” could be said not only of remittance taxes that explicitly target immigrants but also those that disproportionately affect undocumented migrants despite formal neutrality.

Others have characterized remittance taxes broadly as a “crude and regressive”[110] consumption tax, or “overtaxation,” punishing migrants who choose to support loved ones abroad rather than local businesses.[111] The taxes act to keep migrants’ funds within the domestic community where the funds are accumulated. Other tax-related efforts connecting capital and human flight include revoking citizens’ passports for federal tax debts and punishing noncitizen tax evasion through deportation.[112]

Remittance taxation and attendant anti-immigrant sentiments are not uniquely American.[113] Gulf countries,[114] including Oman, the United Arab Emirates, and Bahrain have proposed remittance taxes.[115] Kuwait’s parliamentary financial committee approved a remittance tax, making it the Gulf country that went farthest towards enacting one.[116] The sole female member of Kuwait’s parliament, Safa Al-Hashem, is a major advocate of the tax.[117] Al-Hashem famously wished to tax immigrants “for everything [including] the air they breathe here”[118] in response to a perceived “invasion.”[119] She has promoted the tax as part of her efforts to reduce what she describes as Kuwait’s “demographic imbalance,”[120] the fact that full Kuwaiti citizens comprise a minority of the population.[121] Remittance taxes in Al-Hashem’s imagination are a means to make migrants pay for their unwelcome presence.

When governments tax remittances, they throttle the historic flow of migrants’ earnings to their countries of origin. This restriction interferes with migrants’ provision of economic support to those they left behind. If sufficiently high, a migration tax may discourage such economic migration—potentially reflecting the intent of that tax and echoing the purpose to which the revenue is devoted.

III. Expelling Capital: Social Security

While remittance taxation guards capital—keeping the proceeds of migrants’ economic activity within a country and reducing the incentive to migrate—states can also expel capital and, correspondingly, migrants behind that capital.

This Part considers the complicated structure of Social Security. I parse the technical history of Social Security benefits to uncover how, despite common refrains suggesting otherwise, undocumented immigrants’ unauthorized work may earn Social Security benefits.[122] And yet, conditions on lawful status limit where immigrants may be when receiving benefits, as distinct from where they were when they earned benefits. As such, even entitled immigrants may be compelled to leave the country for Social Security benefits. Capital expulsion, here conditioned on American immigration status, advances migrant expulsion.

First, a brief introduction on social security generally. Social Security benefits (paid as annuities) are estimated to comprise the majority of income for tens of millions of beneficiaries.[123] At any point in time, those benefits are largely funded by payroll taxes on current workers’ wages, nominally divided between workers and employers.[124] This is described as a “pay-as-you-go” system.[125] Since the 1980s, the Social Security Administration (SSA) has collected more in taxes and other income each year than it pays out in benefits.[126] The Social Security Trust Funds, one for old-age benefits and one for disability, account for excess receipts and invest this income in Treasury securities.[127] However, benefits are soon expected to outstrip incoming taxes, requiring the SSA to draw on the Trust Funds. Over time, demographic changes are expected to wear down the Trust Funds, leaving them fully depleted in a few decades, if not sooner.[128] The Social Security Trust Funds can be understood as substantial public capital that can temporarily, but not in perpetuity, fund individual benefits.[129]

In analyzing how the capital controls embedded in the Social Security system may exile migrants, I turn first to the entitlement restrictions—which limit eligibility for benefits—before turning to payment restrictions—which limit payment for otherwise eligible individuals.

A. Entitlement Restrictions

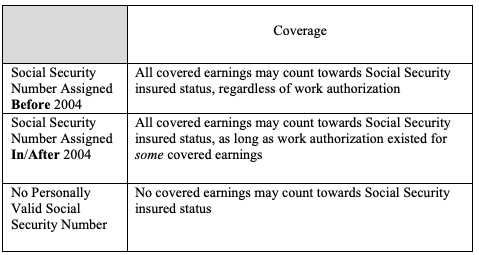

Contrary to common belief, undocumented immigrants can become entitled to Social Security benefits, with more recent immigrants admittedly facing greater hurdles.[130] Noncitizens historically faced few barriers to entitlement—the Social Security Administration (SSA) began limiting its issuance of SSNs primarily to individuals authorized for employment in the United States only in 1995.[131] Even after immigrants without work authorization lost the ability to obtain a Social Security Number, they could still accrue covered quarters of earnings.[132] In 2004, however, Congress limited eligibility with the Social Security Act of 2004,[133] which requires claimants to have had a work authorized-Social Security number at some time to gain benefits entitlement based on covered earnings.[134]

The current regime creates a tripartite taxonomy, leaving recent immigrants who are neither citizens nor legal permanent residents adrift.[135] First, immigrants who received Social Security numbers prior to 2004 who never possessed valid work authorization may still gain entitlement for all covered earnings.[136] Similarly, individuals who received SSNs in or after 2004 and had work authorization for some earnings will gain entitlement based on all earnings.[137] Thus, undocumented immigrants who arrived to the United States early enough, or who possessed work authorization at some point, may become entitled.[138]

Yet the third group, recent arrivals who never hold work authorization, cannot count their earnings towards entitlement.[139] Individuals in this final group, when using Social Security numbers that do not match their name, have their “wages” placed in an Earnings Suspense File (ESF) by the Social Security Administration.[140] The SSA’s Office of the Chief Actuary estimates that each year, millions of foreign national workers without work authorization use Social Security numbers that are not personally valid, generating billions of dollars annually in payroll taxes that may never be claimed.[141] Such “scrambled” wages can be unscrambled—the SSA “[a]dvise[s] the [undocumented immigrant] that if he should be lawfully admitted to the U.S. with permission to work to recontact SSA for . . . credit of his/her prior earnings.”[142] The three groups created by the current Social Security system are summarized by Table 2 at the end of this section.

The conditional language—that Social Security may never be claimed by those having no Social Security number—reflects not only the need to unscramble or “reconcile” but also the ongoing uncertainty over Social Security’s place in immigration reform.[143] Consider the Border Security, Economic Opportunity, and Immigration Modernization Act of 2013 (BSEOIMA), introduced and passed in the Senate before ultimately dying in the House.[144] That Act would have granted “registered provisional immigrant” (RPI) status,[145] which includes work authorization,[146] while nonetheless ending RPI recipients’ ability to count unauthorized work prior to obtaining RPI toward Social Security quarters of coverage.[147] This would be an exception to the general rule for SSNs issued since 2004—BSEOIMA would disallow the eventual counting of past, covered quarters. Such a disallowance has also been proposed for those who already have Social Security numbers. For instance, the “No Social Security Numbers and Benefits for Illegal Aliens Act of 2015” would have prevented Deferred Action for Childhood Arrivals (DACA) recipients from ever becoming entitled to Social Security.[148]

To summarize, while undocumented immigrants may become, and have become, entitled to Social Security benefits, recent cohorts face more stringent requirements. Contemporary Congressional proposals have tried to further limit Social Security entitlement, viewing these capital flows as sites of immigration enforcement.

Table 2: Social Security Insured Status by Year of Social Security Number Assignment

B. Payment Restrictions

Beyond entitlement restrictions, payment restrictions pose a distinct barrier to Social Security receipt. The Social Security Administration will not pay entitled noncitizens if they are not lawfully present in the United States, a policy effected by the Illegal Immigration Reform and Immigrant Responsibility Act of 1996.[149] If noncitizens do not obtain lawful status, they may have to leave the country in order to receive their benefits. In other words, an undocumented worker of Brazilian nationality who returns to Brazil may be paid their benefits upon departure from the United States, but not before.[150]

Even after leaving the United States, noncitizens may not be able to receive payments to which they are entitled. Under the statutory default rule, a noncitizen may receive benefits for only six months after leaving the United States.[151] However, this default rule is subject to a number of exceptions that allow payments to the citizens of specific countries around the world—albeit to varying degrees.[152] This variation is particularly stark for survivors and dependents. Brazilian national survivors and dependents can be paid regardless of their tenure inside or outside the United States.[153] But while Mexican, Guatemalan, and Salvadorian nationals collecting on their own Social Security records are treated similarly,[154] their survivors and dependents must have lived in the United States for a minimum period of time or face payment cutoff.[155]

Beyond restricting payments based on the citizenship of the beneficiary, the Treasury restricts the payment of government benefits to blacklisted countries— currently Cuba and North Korea.[156] Moreover, no beneficiary, whether or not they are a U.S. citizen, may receive benefits while residing in certain former republics of the Soviet Union unless the agency makes an individualized exception.[157] As such, a Moldovan citizen who moved to the United States and became entitled could not return to Moldova without giving up their Social Security benefits, and nor could her Mexican spouse or U.S. citizen child.[158]

Unlawfully present noncitizens may thus accumulate rights to capital (Social Security benefits), but the benefits will not be paid until after departure. This set of policies thus expels capital, perhaps as a means to expel migrants themselves.[159] These byzantine payment restrictions create a Faustian bargain: relinquish your adopted homeland or relinquish your capital. These restrictions complement Congress’s continued entertainment of proposals limiting Social Security entitlements for once work-authorized immigrants— including DACA recipients. Thus, nationality-based Social Security entitlement and payment controls act as migrant controls.

IV. Marginalizing Capital: Personal Accounts

The previous two Parts addressed how tax and public benefit laws can operate to guard or expel capital. This Part considers how the American financial system marginalizes migrants’ capital.[160] The marginalization of migrants’ capital marginalizes the migrants themselves, altering behavior without expressly controlling entry and exit.

The admittedly sparse empirical research suggests that undocumented immigrants have relatively limited engagement with the traditional banking system.[161] In one study utilizing a snowball sample of undocumented debtors in New York and New Mexico, only a minority of respondents appeared to have a bank account.[162] This lies in contrast to the general population, of whom the Federal Reserve estimated that a majority are “fully banked.”[163] Data from the Mexican Migration Project similarly reveals that undocumented immigrants in the sample are less likely to have bank accounts than their documented counterparts.[164]

This Part examines the role of customer identification requirements in marginalizing migrant capital. The governing statutes are the Providing Appropriate Tools Required to Intercept and Obstruct Terrorism (PATRIOT) Act and REAL ID Act, early twenty-first century laws emerging from the post-September 11, 2001 “war on terror” that address banking and identity verification.[165] Social movements responded to these exclusionary federal laws by demanding subnational innovation, including through the creation of municipal IDs, as well as financial institution acceptance of identification provided by other countries.[166] Nonetheless, financial institutions continue to be uncertain and inconsistent in their treatment of migrants’ capital.

A. Identifying Capital and Customers

Modern American banking compels identity disclosure.[167] Anti-money laundering (AML) laws, beginning with the Bank Secrecy Act, have sought to curb the flow of illicit money by requiring financial institutions to verify customer identities.[168] The requirements to identify and maintain customer records became increasingly strict during the “War on Drugs.”[169] Then, after the terrorist attacks on September 11, 2001, further anti-money laundering efforts surfaced in the “war on terror.”[170] The PATRIOT Act amended the Bank Secrecy Act and tasked the Treasury with creating a regulatory framework for financial institutions’ customer identification, including “reasonable procedures” for both “verifying the identity of any person seeking to open an account” and maintaining customer identity records.[171] The regulations govern “accounts,” a statutory term that includes formal banking relationships but notably excludes one-off services including wire transfers.[172] U.S. law has introduced multiple capital controls to respond to perceived social threats, whether drug traffickers, terrorists, or migrants.

The regulations afford significant discretion to financial institutions to verify accountholder identity. Financial institutions include banks, MTOs, and even casinos.[173] The multiagency regulations mandate that customer identification programs (CIPs)[174] require dates of birth and “identification numbers” for accounts.[175] The identification number requirement explicitly allows noncitizens to provide Individual Taxpayer Identification Numbers (ITINs) from the U.S. government, foreign passports, or “any other government-issued document evidencing nationality or residence and bearing a photograph or similar safeguard.”[176] Nonetheless, a healthy minority of immigrants appear to incorrectly believe that Social Security numbers are required by banks to open accounts.[177] Consumers are thus unsure about which identification will satisfy banks, who in turn face uncertainty regarding what will satisfy financial regulators.

Non-account holders who nonetheless seek ad hoc services are also subject to identity verification. Financial institutions are obligated to verify identification documents for non-“established” customer transfers over $3,000 or make “a notation in the record of the lack [of identification] thereof.”[178] These requirements apply to a wide range of institutions, including banks and MTOs like Western Union, whether or not the wire transmission crosses a border.[179] The Financial Crimes Enforcement Network (FinCEN), a bureau of the Department of the Treasury, proposed lowering the threshold and imposing further recording requirements for cross-border transactions, but has not yet done so.[180]

As banks have left behind those customers perceived as risky under these “know your customer” standards, money transfer businesses like Western Union have offered their services.[181] Yet with this new openness has come new liabilities. Western Union has been subject to hundreds of millions of dollars in fines for violations of federal financial law pursuant to the identification and transaction requirements that also cover MTOs.[182]

These twenty-first century financial identification requirements bear resemblance to twentieth century immigration law’s introduction of employee identification requirements through the I-9.[183] FinCEN notably made this immigration analogy in a recent rulemaking.[184] These rules—part of broader transnational efforts to prevent the misuse of the corporate form by “illicit actors”[185] and more generally “safeguard the financial system against illicit use”[186]— justify identity verification by pointing to immigration law’s use of identity verification in employment.[187] Controls combatting “illicit” capital draw inspiration from controls combatting illicit migration.

B. Identifying People

While uncontested elsewhere, the legal sufficiency of certain identification for financial institutions remains ambiguous. Consider the driver’s license. Oft-considered a “talismanic pass to life,” the driver’s license affords not only legal permission to drive, but also often access to health care and a range of public utilities and benefits.[188] If that license is not compliant with the REAL ID Act, however, it may be unable to secure financial access. Similarly, individuals may currently use their matricula consular at some, but not all, financial institutions.[189]

The REAL ID Act of 2005 (REAL ID) changed the availability and meaning of both the American driver’s license and the matricula consular. Passed one year after the PATRIOT Act, REAL ID precludes a Federal agency from accepting, for any official purpose, a state driver’s license or identification card unless the issuing process meets certain requirements.[190] Those requirements include “valid documentary evidence” that the person possesses lawful immigration status. Lawful immigration status for this purpose includes pending applications for either asylum or temporary protected status, as well as approved deferred action status.[191] Since the matricula consular, issued by Mexico and other countries, does not speak to one’s immigration status in the United States, it is not REAL ID-compliant.

After over a decade of delayed implementation, DHS announced that by October 1, 2021, travelers must present a REAL ID-compliant driver’s license or identification card to fly within the United States.[192] Ominously, over a decade ago, the ACLU warned of REAL ID’s potential to transform our lives, including access to banking: “The law places no limits on potential required uses for REAL IDs. In time, REAL IDs could be required to . . . open a bank account [or] go to an Orioles [baseball] game . . . .”[193] REAL ID began with our roads and skies, but could move far beyond in the future.

The REAL ID-compliant driver’s license thus may offer keys to many areas of life, but the three primary identifications available to undocumented or interstitial immigrants may provide limited mileage. First, consider non-REAL ID compliant licenses.[194] At the time of publication, sixteen states, Puerto Rico, and the District of Columbia offer some form of driver’s license without regard to immigration status.[195] REAL ID excludes such driver’s licenses and denies them federal privileges. A second form, the municipal ID, contains the ID holder’s name and photograph and is often offered by cosmopolitan cities.[196] Due to the attached cultural and social benefits in places like New York, San Francisco, and Philadelphia, many citizens also possess municipal IDs.[197]

Beyond the non-REAL ID compliant licenses and municipal IDs, the aforementioned matricula consular rounds out the three primary forms of identification. While government officials and scholars alike have associated the matricula consular with “illegal aliens,”[198] its identification power has evolved since the PATRIOT Act’s passage through additional security measures in issuance and fraud prevention.[199] The current requirements include (i) proof of Mexican nationality, (ii) an official proof of identity (Mexican or American), and (iii) a proof of address within the corresponding American consular district.[200] Additionally, a criminal record or contemporaneous prosecution may be disqualifying.[201] Some cities and states accept the matricula consular for purposes of obtaining a non-REAL ID compliant license or a municipal ID,[202] and a foreign national may use an American state-issued license for purposes of obtaining a matricula consular.[203] However, other states have been more restrictive in their recognition of the matricula.[204]

Beyond potentially being insufficient for financial institutions, non-REAL ID licenses also come with their own separate risks. In response to state concerns about DMV data, an ICE spokeswoman said that the “agency doesn’t generally use state motor-vehicle data to ‘identify immigration enforcement targets,’” but could try to use such data in support of ongoing “criminal investigations.”[205] Opponents of unlawful immigration have unsuccessfully tried to use FOIA laws to reveal the addresses and names of municipal ID holders.[206] These risks notwithstanding, localities, banking groups, and immigrant rights nonprofits alike have supported undocumented immigrants’ use of these IDs in pursuit of inclusionary banking.[207]

In sum, identification requirements in American finance operate as capital controls. Even relatively privileged immigrants and consumers perceived to be immigrants have found their accounts suspended due to their bank’s uncertainty about proper identification.[208] These rejections marginalize migrant capital and foreshadow conflict, particularly as American immigration opponents continue to call for boycotts of banks that accept immigrants’ non-American identification like the matricula consular.[209] Such boycotts attest to a collective understanding that these capital controls operate as migrant controls.

V. Constitutional and Legal Constraints

In this Part, I explore the constitutional and other legal issues that arise from the three aforementioned capital controls of remittance taxation, social security, and personal accounts. I focus on “dormant” foreign affairs preemption, Commerce Clause concerns, and immigration federalism principles arising from state remittance taxation’s design; the unconstitutional choices and conditions arising from Social Security’s design; and the financial power of non-REAL IDs—non-REAL ID licenses, municipal IDs, and matricula cards—in light of the PATRIOT Act. I explain how each of these capital controls interact with constitutional, federalism, and immigration law theories.

A. Remittance Taxation

I consider three theories that bear on the constitutionality of state remittance regulation:[210] dormant foreign affairs preemption, the dormant Commerce Clause,[211] and immigration federalism. Dormancy refers to the fact that state action may be impermissible even “when the federal government is silent,” or dormant.[212] Scholars often distinguish these dormant theories from other Supremacy Clause-based preemption arguments.[213] Dormant preemption preserves the federal government’s ability to speak with “no voice” or a “quiet voice.”[214] For example, the federal voice is loud and clear in the context of regulating employment of undocumented immigrants, in contrast to relative federal silence regarding those same immigrants’ remittances.[215] These theories help explain that some state proposals to tax remittances are on more tenuous doctrinal ground.

1. Foreign Affairs Preemption: Courts’ Interpretation and a Framework for Analysis

Federal courts have defined rough limits on local and state activities related to foreign affairs, grounded in several constitutional provisions.[216] The foreign-affairs preemption doctrine finds inspiration in the Federalist Papers, where James Madison explained “[i]f we are to be one nation in any respect, it clearly ought to be in respect to other nations”[217] However, some state activity touching upon foreign affairs is inevitable and constitutionally permissible.[218] The Supreme Court addressed the issue in Zschernig v. Miller[219] and Am. Ins. Ass’n v. Garamendi,[220] and those cases and intervening lower-court decisions outline the foreign affairs preemption doctrine.

In Zschernig, the “quintessential” dormant foreign affairs preemption case,[221] the Supreme Court struck down an Oregon statute governing intestate succession laws for a “nonresident alien.”[222] The statute required, in part, for the noncitizen to establish that she might inherit disputed property “without confiscation” by foreign governments.[223] The Supreme Court expressed grave concern that state probate courts were sitting in judgment of foreign nations to identify “any element of confiscation” “in the particular foreign system of law.”[224] Thus, the Court concluded that the state statute unconstitutionally intruded into the field of foreign affairs.[225]

Zschernig has been characterized as comprising “the general dormant foreign-affairs doctrine.”[226] It was also “unique”:[227] the government’s amicus brief made clear to the court that it did not believe that the Oregon statute “unduly interferes with the United States’ conduct of foreign relations.”[228] And yet, the Supreme Court found the Oregon statute preempted.

The Supreme Court’s second and later foreign affairs preemption decision, Am. Insurance v. Garamendi, drew upon Zschernig to strike down a California statute permitting redress for historic “taxes” collected upon those fleeing Nazi genocide.[229] As the Supreme Court explained, Jewish people “who tried to emigrate from [Nazi] Germany were forced to liquidate insurance policies to pay the steep ‘flight taxes’ and other levies imposed by the Third Reich to keep Jewish assets from leaving the country.”[230] California’s Holocaust Victim Insurance Relief Act of 1999 (HVIRA) required insurers doing business in California to disclose information about the historical totality of its European business.[231]

As others have noted, both the majority and dissent declined to provide a dormant Foreign Commerce Clause analysis.[232] The Court found that HVIRA unconstitutionally interfered with the federal government’s role in foreign relations because it interfered with executive foreign policy, namely agreements forged with Germany, Austria, and France to settle insurance-based claims.[233] Thus, some commentators have painted Garamendi as concerning preemption by bilateral agreements rather than dormant preemption.[234]

While both dormant foreign affairs preemption cases limit state activity, Zschernig and Garamendi also differ. In her Garamendi dissent, Justice Ginsburg argued for limiting Zschernig’s “dormant foreign affairs preemption” closer to Zschernig’s facts, where a state sat in judgment of a foreign sovereign.[235] One commentator contrasted Zschernig and Garamendi as reflecting, respectively, dormant foreign affairs preemption and executive preemption.[236]

Most importantly, the pair of opinions raised, but left unanswered, the permissible scope of state remittance taxation.[237] Garamendi suggested that if a state acts within “its ‘traditional competence,’ but in a way that affects foreign relations,”[238] a court might require a minimum significance for the conflict to require preemption. The minimum would vary “with the strength or the traditional importance of the state concern asserted.”[239] Such a rubric suggests that the state’s authority in health, safety, and taxation, which is “recognized as central to state sovereignty,”[240] may be particularly robust against foreign affairs preemption.[241]

Lower courts have filled in doctrinal gaps that the Supreme Court left in foreign affairs preemption. Between Zschernig and Garamendi, the federal courts applied a five-factor test to determine preemption of a Massachusetts law that limited state procurement from firms doing business in Burma.[242] In National Foreign Trade Council v. Natsios, the First Circuit found that the Massachusetts Burma law violated the foreign affairs power, as well as the dormant Foreign Commerce Clause.[243] While acknowledging Zschernig’s boundaries as “unclear,”[244] the First Circuit paralleled Massachusetts’s scrutiny of firms’ business in Burma with Oregon probate courts’ scrutiny of sovereigns in Zschernig. The First Circuit then characterized the Burma law as having more than an incidental effect on foreign relations.[245] In particular, the First Circuit noted five persuasive factors: [1] “the design and intent of the law [as] to affect the affairs of a foreign country,” [2] economic power to effectuate that design and intent, [3] the possibility of being a “bellwether” for other states, [4] foreign protests, and [5] divergence from federal law.[246] When the Supreme Court reviewed the Natsios decision in Crosby v. National Foreign Trade Council, it avoided addressing both the foreign affairs and Foreign Commerce preemption issues and affirmed instead on conflict preemption grounds.[247] Federal and state courts have continued to cite to Natsios’s five factors to determine whether a state law encroaches upon the federal foreign affairs power.

Foreign affairs preemption concerns might then arise for state remittance taxation, particularly when taxation targets specific destination countries (unlike the extant Oklahoma law). In Zschernig, the Supreme Court took issue with a statutory construction yielding “unavoidable judicial criticism” aimed specifically at “nations established on a more authoritarian basis than our own.”[248] Federal courts post-Zschernig have interestingly contrasted the state statute in Zschernig, which “generally applied only against residents of a narrow set of countries,” with the statute in Garamendi, which “applied to insurers from any country.”[249] While Garamendi ultimately found the state statute preempted, it did so with reference to express foreign policies in executive agreements with European countries.[250] As such, targeted countries might suggest that the state “intended the statute to send an explicit foreign relations message, rather than simply to address some local concern.”[251] That targeting of countries, and underlying intent to send a targeted foreign relations message, weighs in favor of foreign affairs preemption.

The Oklahoma remittance tax facially targets all cross-border flows, which may redeem it against arguments that it sends a targeted foreign relations message and is thus preempted. The state law’s design is universalist, as compared to subsequent federal proposals like the Border Wall Funding Act of 2017 (BWFA). The BWFA targeted remittances if the designated recipient belonged to certain countries, including Mexico and Central American countries.[252] However, the universality of the design may be undermined by the intent of the Oklahoma tax’s drafter, who defended the law by arguing that it “burdens mostly illegal immigrants and drug traffickers from Mexico who wire illegal proceeds back to their home country.”[253] Foreign counterparts interpreted the tax as fundamentally concerning immigration, even if the sponsor’s statement nominally concerned crime.[254] Threats of foreign retaliation and the professed intent are both factors to be considered under the Natsios test.[255] Beyond its universal design, Oklahoma’s tax has limited economic power, does not appear to be a bellwether quite yet, and does not explicitly diverge from current federal policy. Thus, although the Oklahoma law catalyzed foreign protest, in part due to design and intent, it is likely on firm constitutional ground under the holistic Natsios analysis.

In contrast to the Oklahoma remittance tax, the designs of the proposed California law and proposed amendment to Oklahoma’s law—each of which condition remittance taxation on the immigration status of the sender—raise more significant foreign affairs preemption concerns. While targeting undocumented immigrants through remittance taxes is facially nationality-neutral, it may distinctly affect Mexican nationals given demographic estimates of Oklahoma’s undocumented population.[256] Despite the Oklahoma and California proposals’ similarities, their differences may also be legally significant. Oklahoma’s proposed amendment would add an additional tax on international transmissions from senders who could not provide proof of immigration status, practically connecting Oklahoma’s design and intent to the field of foreign affairs.

California’s proposed tax differs because it taxes all transmissions—including those to domestic destinations—by undocumented immigrants. The proposed tax would also “pay for emergency medical care” “to persons without documentation of legal residence in the United States.”[257] This is in contrast to Oklahoma’s revenues, which largely benefit the state’s “Drug Money Laundering and Wire Transmitter Revolving Fund.”[258] Given California’s ongoing efforts to include undocumented immigrants in its Medi-Cal system, and the traditional state interest in health and safety, California’s tax design of focusing on undocumented immigrants might, for some, minimize the intent or foreign protest concerns that Oklahoma’s tax might raise.[259]

In sum, if not for the sponsor’s statement explicitly singling out Mexico and the related foreign protest, Oklahoma’s facially nondiscriminatory remittance tax—covering all money transmissions regardless of destination or sender immigration status—might avoid foreign affairs preemption. Evidence of intent and foreign protest moves the tax into less-comfortable constitutional territory but may not be fatal. However, the proposed amendment, which explicitly targets undocumented immigrants, the majority of which are Mexican in Oklahoma, may be. In contrast, California’s similarly proposed design may be on firmer ground because its design and intent, to benefit healthcare for the targeted population, may insulate it from foreign protest. As more remittance tax proposals with new permutations surface, so may dormant foreign affairs preemption concerns.[260]

2. The Commerce Clause: Court Guidance and the “One Voice” Principle

Even if state remittance taxation may survive foreign affairs preemption, it may falter under the Commerce Clause.[261] The Constitution affords Congress the authority “[t]o regulate Commerce with foreign Nations, and among the several States. . . .”[262] This authority is “understood to have a ‘negative’ aspect.”[263] Even as scholars and Supreme Court justices question the doctrine’s legitimacy,[264] the dormant Commerce Clause may render state actions unconstitutional based on their effect on interstate or international commerce.[265] Some scholars have revived the significance of the Commerce Clause’s authority for immigration power, with particular focus on the Foreign Commerce Clause.[266] While I focus on Foreign Commerce Clause challenges, remittance taxes, such as the current Oklahoma law, also implicate interstate commerce when non-international capital flows nonetheless cross state borders.[267]

While “the Supreme Court has had few occasions to offer guidance,”[268] the Foreign Commerce Clause is generally understood to build upon the more regularly invoked Interstate Commerce Clause framework. Courts consider two animating principles to address Commerce Clause challenges to state laws: nondiscrimination between local and nonlocal economic actors and prevention of undue burdens for nonlocal actors.[269] The prohibition on undue burdens means that even laws designed “even-handedly to effectuate a legitimate local public interest” may be struck down if “the burden imposed on such commerce is clearly excessive in relation to the putative local benefits.”[270] For state taxation of interstate commerce, Complete Auto Transit, Inc. v. Brady explains that a tax may survive a Commerce Clause challenge if it “[i] is applied to an activity with a substantial nexus with the taxing State, [ii] is fairly apportioned, [iii] does not discriminate against interstate commerce, and [iv] is fairly related to the services provided by the State.”[271]

Japan Line, Ltd. v. County of Los Angeles expands on Complete Auto to lay out the doctrinal test for a Foreign Commerce Clause challenge to a state tax.[272] Under Japan Line, when a state seeks to tax foreign commerce, two additional considerations beyond Complete Auto’s interstate commerce factors surface: “first, whether the tax, notwithstanding apportionment, creates a substantial risk of international multiple taxation, and, second, whether the tax prevents the Federal Government from ‘speaking with one voice when regulating commercial relations with foreign governments.’”[273] This final criteria of preserving “one voice” in the regulation of foreign commercial relationships bears resemblance to the dormant foreign affairs preemption analysis.[274] The Supreme Court has tried to keep the doctrines separate,[275] but federal courts continue to remark on their fundamental similarity.[276]

Barclays Bank PLC v. Franchise Tax Board, a significant Foreign Commerce Clause challenge, grappled with the “one voice” criterion.[277] The Supreme Court upheld California’s use of “worldwide combined reporting” for corporate income tax.[278] Barclays’s “most energetically presented” question was whether California’s taxation scheme impaired federal uniformity by preventing the nation from “‘speaking with one voice’ in international trade.”[279] The Court answered this question in the negative.[280] Despite executive branch protest against California’s policy, Congress had on multiple occasions rejected legislation that would have outlawed California’s reporting system.[281] Given such congressional “tolerance” for worldwide combined reporting, the Court concluded that U.S. foreign policy was not so seriously threatened as to prevent states from “tax[ing] as they please.”[282]

Even as scholars criticize it, the “one voice” question hovers over any foreign commerce challenge to state remittance taxes.[283] Per Barclays, executive protest alone may be unlikely to constrain state authority. [284] Rather, the question becomes one of congressional tolerance, where foreign affairs and commerce concerns are unlikely to outlaw state actions that Congress considered and refused to outlaw itself.

Somewhat analogously, Congress’s refusal to pass multiple remittance tax proposals, including those targeting specific countries, may weigh against parallel state efforts. The unsuccessful Border Wall Funding Act of 2017 designated specific destination countries, including Mexico, for remittance taxation, and subsequent federal remittance tax proposals taxing all international remittances have also failed.[285] Congress’s refusal to institute such taxes is unlikely to be construed as yielding the floor to others, particularly in the context of destination-country-specific taxation. Rather, Congress appears to be using its voice to preserve a freer flow of remittances. Thus, in light of Barclays and Congress’s consideration of, but refusal to, tax international remittances, similarly structured state proposals may violate the “one voice” expectation in foreign commercial relations.[286]

3. Immigration Federalism: Does Intent Matter?

Finally, if we do consider remittance taxes to constitute a form of migration control, that suggests that immigration federalism principles may limit state and local governments’ efforts.[287] Courts have regularly struggled to determine the extent to which federal law preempts state and local immigration-related policies.[288] But courts have also rejected states’ attempts to regulate individuals based on their “authorization” to be in the United States, as those nuanced determinations are best left to federal authorities.[289] Apart from that distinction, however, courts are notably deferential to state tax policies, even if those tax policies have an immigration-related effect.[290] Although some have argued that an immigration-related intent should be considered as part of the immigration-federalism analysis, courts have largely declined to adopt that approach.[291] As a result, even uncontested legislative intent to affect immigration flows may not sink Oklahoma’s status-neutral law.[292] In short, immigration federalism is unlikely to limit the remittance taxes described in this Article.

To conclude, the taxation of remittances can take on multiple forms, each with distinct constitutional considerations. Capital controls that might seemingly reflect permissible use of state tax authority raise constitutional issues if, by design and intent, they become migrant controls targeting undocumented immigrants and particular remittance-destination (or migrant-sending) countries.

B. Social Security

Beyond remitting capital abroad, migrants may wish to collect upon capital earned in the United States and to spend it here as well. Social Security provides one significant example of this desire, but the law raises a number of hurdles for noncitizen beneficiaries. While Social Security denies payments of benefits to those who are not “lawfully present in the United States,” administrative regulations clarify the qualifying immigration statuses.[293] The current regulations include three categories of migrants—recipients of Temporary Protected Status, asylum applicants, and those in deferred action status—as “lawfully present” for the purposes of Social Security benefits.[294] Accordingly, Social Security benefits comprise an underappreciated ground of immigration administration and raise questions about the reach of an agency’s powers.

A new administration could work to change the meaning of lawful presence for Social Security purposes to exclude these three non-statutorily enumerated categories. This could serve as a powerful form of migrant control. Elderly asylum applicants who face a particularly long determination may accrue the ten years of credit required for benefits prior to their ultimate asylum determination. Applicants would either have to leave the country or give up their rights to Social Security during the pendency of their asylum determination.[295] Similarly, a Haitian national who arrived in the United States in 2010 at age sixty and availed themselves of Temporary Protected Status (TPS) work authorization would find themselves facing a difficult choice.[296] Finally, if DACA recipients approach old age without adjustment of status, they too will rely on administrative grace to remain in the United States while collecting their earned Social Security.

Such policies might disproportionately expel poorer immigrants from particular racial and national backgrounds.[297] These nominal capital controls therefore become controls on poor migrants.

Administrative changes to limit Social Security payment would raise the specter of both “unconstitutional conditions” and “unconstitutional choice” doctrines. Mention of both of these doctrines has surfaced in the broader TPS termination context as well.[298] The “unconstitutional conditions” doctrine precludes compelled choices between discretionary benefits and a constitutional right.[299] The related “unconstitutional choice” doctrine precludes compelled choices between constitutional rights.[300] These doctrines are closely intertwined in judicial decision-making. For example, the Sixth Circuit invoked an unconstitutional conditions holding to strike down, on unconstitutional choice grounds, a regulation that “compels the conscientious objector either to engage in military training contrary to his religious beliefs, or to give up his public education.”[301]

Both doctrines place limits on how capital controls might be used as migrant controls. To understand why this is so, consider an administrative rescission eliminating Temporary Protected Status’s eligibility for Social Security benefits.[302] Because TPS was extended to El Salvador in 2001, a hypothetical sixty-five-year-old Salvadoran woman with a citizen child was able to work for a decade and earn Social Security eligibility.[303] And yet, an administrative rescission establishing that TPS is no longer considered “lawfully present” for Social Security benefits would mean that, despite her eligibility for benefits, her receipt of those benefits is conditioned on her expulsion from the United States.

First, she could challenge the rescission in her own capacity under the “unconstitutional conditions” doctrine, which limits the conditions that may attach to otherwise discretionary government benefits when those conditions burden a constitutional right.[304] For example, in Sherbert v. Verner, the Supreme Court invalidated a South Carolina law denying unemployment benefits to religious claimants who refused employment that would require them to work on Saturday, thus burdening their First Amendment rights.[305] The “unconstitutional conditions” doctrine aims to “vindicate[] the Constitution’s enumerated rights by preventing the government from coercing people into giving them up.”[306] In practice, however, distinguishing between impermissible coercion and permissible contingencies remains difficult.[307]

Our hypothetical beneficiary of Temporary Protected Status has a statutory but qualified right to remain in the United States, giving rise to substantive due process interests.[308] Substantive due process captures how the Constitution bars “certain government actions regardless of the fairness of the procedures” in order “to prevent governmental power from ‘being used for purposes of oppression.’”[309] While a TPS beneficiary is not among the “most favored category” of undocumented immigrants, a categorization reserved for lawful permanent residents, Congress explicitly created TPS and granted its beneficiaries legal legitimacy.[310] The beneficiary’s statutory, though qualified, right to remain in the United States during the TPS period thus creates constitutional interests.

If Homeland Security excluded TPS from the list of “lawfully present” statuses, however, her ability to receive Social Security benefits would be conditioned on her departure.[311] This troubling, and I argue unconstitutional, condition would arise even though she has not been accused of or detained for the type of immigration or criminal violations for which the Supreme Court has found substantive due process arguments uncompelling.[312] Thus, while the “broad power over naturalization and immigration” means that Congress can and does “regularly make[] rules that would be unacceptable if applied to citizens,” the administrative termination of Social Security receipt for TPS recipients may nonetheless be unconstitutional.[313] Administratively conditioning a statutorily-lawfully present migrant’s entitlement receipt on a “self-deportation” raises concerns about unconstitutional conditions.[314]

Second, beyond the parent, consider the “unconstitutional choice” faced by her citizen child. If TPS is no longer considered “lawfully present,” the mother would need to leave the United States to receive the Social Security benefits that provide her financial security. Again, this departure would be compelled even though the mother is lawfully present under Congress’s passage of the TPS statute. The mother’s departure would force her child into a troubling choice, either to depart the country for her mother’s homeland, an unfamiliar place, or to live without her.

Fundamental substantive due process rights have long attached to the family and a child’s right to live with their parents.[315] Incursions on such “fundamental” rights are often subject to strict scrutiny.[316] Yet, as the Ninth Circuit explained to an immigrant plaintiff with a criminal conviction for certain offenses against a child, “the generic right to live with family is far removed from the specific right to reside in the United States with noncitizen family members.”[317] The federal courts of appeals have consistently rejected children’s family-based constitutional arguments and upheld the removal of undocumented parents.[318]

While a federal court recently avoided deciding whether terminating multiple countries’ TPS status might unconstitutionally infringe U.S. citizen children’s substantive due process rights in Ramos,[319] the court’s preliminary analysis is instructive. In Ramos, the court acknowledged that the government’s interest in enforcing immigration laws through parental deportation often trumps the substantive due process interest in family unity.[320] However, the court in Ramos faced a different situation, and interest, than our hypothetical migrant. Put simply, the termination of TPS is distinct from the rescission of TPS-based receipt of Social Security benefits. While TPS exists, Congress has explicitly decided not to remove these parents — they are permitted to stay, yet they, likely with their children, would need to leave to receive their earned capital after an administrative rescission. Therefore, while TPS exists, a child may legally challenge the latter administrative rescission as an “unconstitutional choice,” even though TPS’s legitimate termination could render the administrative question of Social Security receipt moot.

While immigration law’s enforcement is not usually held to violate substantive due process, Congress has allowed these migrants to remain and therefore constrained administrative action. Even if “the evenhanded enforcement of the immigration laws, in and of itself, cannot conceivably be held to violate substantive due process,” termination of TPS-based receipt of Social Security benefits is distinct from enforcement of the immigration laws. This is partly because an agency has interfered in Congress’s establishment of at least temporary immigration relief.[321] The “unconstitutional choice” doctrine should apply here to prevent the government from denying Social Security benefits; otherwise, the TPS beneficiary’s exercise of constitutionally protected “freedoms would in effect be penalized and inhibited.”[322]

Traditionally, plenary power doctrine extends to Congress’s choices, and here Congress has made the choice to allow the individual to benefit from prosecutorial discretion and work authorization.[323] Thus, plenary power doctrine may not rescue agency action to create domestic Social Security receipt ineligibility for interstitial immigrants, even as it has recently supported administrative and executive actions. More theoretically, plenary power cannot rescue the administrative creation of unconstitutional choices and conditions. When such capital controls are transformed administratively into stricter migrant controls, the “famous” immigration deference doctrines that attach may not suffice to save them.[324]

C. Personal Accounts

When migrants are unable to obtain identification that allows access to formal financial institutions, they and their capital are marginalized. This Section considers the intersection of the PATRIOT Act and REAL ID Act to establish how statutory and administrative ambiguity leads to the marginalization of migrant identity and migrant capital. As mentioned above, while REAL IDs likely suffice for the PATRIOT Act, non-REAL IDs may not. The sufficiency of non-REAL IDs—non-REAL ID compliant driver’s licenses, municipal IDs, and the matricula consular—bears directly on migrants’ ability to engage with the financial system, and indirectly on the perception of these documents’ validity more generally.[325]

Nothing in the law deems a non-REAL ID compliant license sufficient to verify a bank customer’s identity or requires a bank to accept one. The anti-money-laundering regulations express that banks “may” use documents including “government-issued identification evidencing nationality or residence and bearing a photograph or similar safeguards, such as a driver’s license or passport.”[326] Yet scholars have already suggested that in areas including banking, “government-issued identification” likely means an identification card compliant with the REAL ID Act.[327] Thus, while REAL ID-compliant driver’s licenses are likely to be sufficient, as a matter of law, for post-PATRIOT Act financial services, the state driver’s licenses and municipal IDs granted without attention to lawful immigration status may not be.