Jet-Setting to Napa Vineyards and Las Vegas Casinos on the Company’s Dime: How the SEC’s Recent Enforcement Actions Expose the Need for Executive Perquisite Reform

Despite the increased attention on executive compensation generally, little scholarship has focused on executive perquisites: benefits granted only to executives above and beyond their salary and untied to their job performance. Since 2006, the Securities and Exchange Commission (SEC) has refused to update its disclosure requirements. Current disclosure loopholes permit companies to obfuscate the actual compensation paid to their executives in controversial forms: nonbusiness related use of the corporate jet for executives and their families, personal entertainment, home security, and tax reimbursements for these perquisites—to name a few. The SEC has recently initiated numerous enforcement actions against companies that violate its existing disclosure rules. However, not a single company subject to an enforcement action received a penalty greater to, or even equal to, the value of the undisclosed perquisites. Moreover, the SEC failed to punish executives culpable in the companies’ nondisclosures sufficiently. Since shareholders have little recourse to hold companies accountable and the SEC refuses to apply consistent or sufficient penalties to prevent inaccurate disclosure, the SEC must, as an initial step, update its deficient disclosure rules for executive perquisites.

Table of Contents Show

Introduction

Discovery, Inc. granted its Chief Executive Officer (CEO), David Zaslav, a compensation package worth $246.6 million in 2021, which included a $4.4 million discretionary cash bonus.[1] Discovery also reportedly paid Zaslav over $800,000 in perquisite compensation for his personal use of Discovery’s corporate jet.[2] This compensation covered Zaslav’s taxes incurred from his personal travel.[3] One year later, the Zaslav-led company initiated multiple layoffs as it looked to reduce spending by billions of dollars.[4] Apple Computer, Inc. paid its CEO Tim Cook a compensation package worth nearly $99 million in 2021.[5] Apple also reportedly paid Cook over $700,000 in perquisite compensation for his personal use of Apple’s corporate jet.[6] One year later, the company lost $1 trillion in market capitalization, laid off workers, and entered a hiring freeze.[7] Alphabet Inc., which boasts one of the technology sector’s lowest CEO-to-worker pay ratios,[8] paid its CEO Sundar Pichai a salary of $2 million in 2021.[9] However, Alphabet also reportedly paid Pichai $4.3 million in perquisite compensation for his “personal security,” which included personal use of Alphabet’s corporate jet.[10] Just over a year later, Alphabet laid off twelve thousand employees,[11] allegedly in response to a billionaire activist investor insisting that the company paid employees too much.[12]

Controversially high executive compensation packages have triggered abundant debates among legal scholars, practitioners, and shareholders for decades.[13] Public scrutiny has even pushed boards to adopt compensation packages increasingly tied to performance and the U.S. Securities and Exchange Commission (SEC) to propagate new disclosure rules, such as requiring companies to disclose the ratio of the CEO’s compensation to the median compensation of its employees.[14]

Despite the attention on executive compensation generally,[15] little scholarship or debate has focused on benefits granted only to executives above and beyond their salary that are unrelated to their performance: executive perquisites (perks). Common executive perks include personal use of a company’s corporate jet for the executive and their family, personal security, financial planning, club membership fees, and tax reimbursements for these benefits. Even as compensation practices evolved and public scrutiny grew, the SEC’s rules governing executive perquisites remained stagnant: the SEC’s last significant amendments to executive perquisite disclosure occurred in 2006.

Even though the SEC has not amended its perquisite rules since 2006, it has recently initiated an unusually high number of enforcement actions against companies that violated perquisite disclosure rules.[16] Such enforcement actions highlight the SEC’s priority of ensuring proper executive perquisite disclosure, but also reveal the inadequacy of the SEC’s rules.[17] The penalties resulting from these enforcement actions are also insufficient to encourage proactive compliance. For example, the SEC settled an enforcement action against Gulfport Energy Operating Corporation in 2021 for its failure to disclose perquisites given to its CEO.[18] Unreported perquisite compensation totaled over $650,000 and included chartered jet trips for his wife and him to a wine tasting in Napa, California and to a poker tournament in Las Vegas, Nevada.[19] Even though the SEC noted the company’s blatantly inadequate internal controls and the CEO’s culpability in the violations, the SEC settled the action without imposing any civil penalty, citing Gulfport’s remedial efforts.[20]

While executive perquisite expenditures might be a small fraction of an executive’s total compensation, the consequences of nondisclosure can be substantial. The SEC’s inadequate disclosure rules and penalties encourage companies to maintain deficient internal controls and processes that may cause companies to habitually underrepresent executive compensation by millions of dollars.[21] This practice impacts compliance beyond perquisite disclosure. For example, Allen Weisselberg, the former Chief Financial Officer (CFO) for the Trump Organization, pled guilty to conspiring with the Trump Organization to evade taxes. He obscured his income through perks like rental payments for his luxury apartment in Manhattan, private school tuition, lease expenses for two Mercedes-Benzes, and cable television.[22] Weisselberg paid no taxes on any of these company-provided perks, which totaled well over a million dollars.[23] This scheme also extended to other executives at the Trump Organization.[24] The Chief Operations Officer (COO), Matthew Calamari, Sr., received benefits like car leases for both him and his wife as well as rent for their Park Avenue apartment.[25] Further, Calamari’s son received rent for his Central Park apartment and $130,000 to renovate it. Neither father nor son paid any taxes on these company-provided benefits.[26] A jury subsequently found the Trump Organization guilty on seventeen counts, including tax fraud and falsifying business records for failing to properly file taxes on such executives perks and bonuses.[27] The Manhattan District Attorney claimed that the scheme, which lasted at least sixteen years, deprived the federal, state, and municipal governments of millions of dollars in tax revenue.[28]

Nevertheless, executive perquisite disclosure violations are also nearly impossible for a shareholder or nonexecutive officer to discover. Those outside the inner orbit of a company’s upper echelon suffer from severe informational asymmetries that preclude discovery. Even if a shareholder uncovers suspicious activity, procedural hurdles to suing a corporation limit their recourse. Therefore, the SEC must amend its disclosure requirements and increase penalties for companies that violate the disclosure rules. These changes are essential to ensure that shareholders and investors are informed of the true value of an executive’s pay and to prevent potential tax evasion.

Accordingly, Section I of this paper distinguishes executive perquisites from other forms of executive compensation. Section II of this paper explores the history of perquisite regulation. Section III will review recent perquisite disclosures and evaluate trends. Section IV will review SEC enforcement actions since 2018. Finally, Section V proposes solutions to increase executive perquisite transparency.

I. Distinguishing Perquisites Within Executive Compensation

Executive compensation packages are assembled to both attract skilled talent and to incentivize executives to maximize value once in the job.[29] How a company builds a compensation package and whether it must be disclosed is often heavily dependent on external requirements. For example, stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ Stock Market (NASDAQ), require that listed companies have a compensation committee comprised of its board of directors to oversee executive compensation packages. Stock exchanges impose additional requirements on the committee to encourage objective compensation decisions.[30] And, agencies like the SEC and the Internal Revenue Service (IRS) impose disclosure and tax requirements on packages to promote transparency.[31]

Executive compensation packages often “consist of six distinct . . . components: salary, annual incentives, long-term incentives, benefits, perquisites and severance/change-in-control agreements.”[32] Compensation packages are also increasingly tied to an executive’s long- and short-term performance.[33] However, executives can extract additional economic rent from their position of power:[34] they may personally capitalize on opportunities presented to their firm; make murky, albeit legal, trades based on nonpublic information; or leverage their power over managers and board members to construct even more favorable compensation structures.[35] Such actions provide executives exclusive benefits that effectively increase the level of pay “above the level implied by salaries, bonuses, and other forms of direct compensation.”[36]

The focus of this paper concerns another aspect of executive compensation: executive perquisites. Unlike other forms of compensation, executive perks are not tied to performance and can therefore reward even the most underachieving executive. The SEC requires disclosure of perquisites under Item 402 of SEC Regulation S-K.[37] Companies, however, only must disclose the perquisites given to its named executive officers (NEO) as described by Item 402 of Regulation S-K.[38] Generally, the company’s Chief Executive Officer, Chief Financial Officer, and the three most highly compensated individuals who are executive officers comprise the NEO group whose compensation, and subsequent perk expenditures, must be disclosed.

After determining whose perquisites must be disclosed, companies must then determine which expenditures are perquisites and how to value them.[39] Instead of offering a bright-line definition, the SEC requires companies to classify expenses as perquisites if they “confer[] a direct or indirect benefit that has a personal aspect, without regard to whether it may be provided for some business reason or for the convenience of the company, unless it is generally available on a nondiscriminatory basis to all employees.”[40] Even though perquisites change with business trends and technological advancements, several categories of perquisites remain fairly consistent.[41] Such categories are as follows:

Travel: Perquisites related to travel are often highly scrutinized. Examples include use of the company’s aircraft for the executive and their friends and family, paid family travel expenses, company cars, mileage reimbursement, leases, ride shares, chauffeurs, and parking.

Insurance Programs: Companies may provide several insurance policies for their executives. Examples include executive group life insurance, split dollar insurance, key person life insurance, executive long-term disability, waiver of insurance waiting periods, medical expense reimbursement, excess retiree medical insurance, pet insurance, or cyber insurance.

Retirement Plans: Companies may also provide enhanced retirement plans to their executives. Examples include nonqualified deferred compensation, nonqualified defined benefit, and nonqualified defined contribution plans.

Employment Guarantees: Despite shareholder resistance, companies may offer executives employment contracts, “golden parachutes,”[42] and severance packages that guarantee income after triggering events. However, perquisites within this category have been the subject of increased and regulation and attention.[43]

Housing: Companies may pay for an executive’s primary or secondary home, apartment, or suite. Moreover, companies may cover the cost of relocating an executive and their family.

Memberships: Companies may also pay for an executive’s membership fees. Traditionally, such clubs may include a country club, athletic club, luncheon club, or executive dining room. However, companies may also pay for membership fees related to an executive’s overall wellness, continued education, or networking communities.

Personal Services: Despite their inherent personal nature, companies may also pay for services like financial counseling, tax preparation, legal services, benefits plans, home security, personal security, or elder care for an executive’s family.

Charity: Companies may also cover an executive’s donation to charitable organizations, charitable events, schools, or nonprofit organizations.

Tax Reimbursements: Another controversial executive perquisite is tax reimbursements known as “gross-ups.” Since executive perquisites are considered income, executives must pay taxes on their value. Therefore, corporations may pay executives to cover the amount owed in taxes on the perquisite. However, once a gross-up is paid to an executive, that too is considered taxable income, which companies may then issue another gross-up to cover. Accordingly, the cost to shareholders or investors can be quite high.

Allowances: Finally, in lieu of offering a specific benefit, firms may provide a cash amount for a designated purpose at an executive’s discretion. For example, a firm may provide a car allowance for executives at $20,000 a year.[44]

II. Evolution of Executive Compensation and Perquisite Regulation

The perceived market failures that preceded the Great Depression spurred federal interest in executive compensation.[45] Decades before Congress passed the New Deal, 1933 Securities Act, or 1934 Securities Exchange Act, the Interstate Commerce Commission[46] ordered railroads to disclose the compensation of executives making more than $10,000 per year.[47] Seemingly incensed by the railroad executives’ high compensation of railroad executives, the federal government required railroad companies to reduce executive pay by up to 60 percent and advised an informal annual salary ceiling of $60,000 per executive.[48] After railroad executives, the federal government turned to banks and “corporations with capital assets over $1 million (which included approximately 2,000 corporations).”[49] The federal government broadened its regulation of compensation disclosure in 1933 and implemented major overhauls to disclosure regulation in 1978 and 2006.

A. SEC Disclosure Regulation from 1933 to 1978

Congress codified general compensation disclosure requirements in the landmark 1933 Securities Act, which required companies to disclose the total remuneration paid to each director, officer, or person whose payment exceeded $25,000.[50] Shortly thereafter, Congress enacted the Securities Exchange Act of 1934, which vested the responsibility of enforcing executive compensation disclosure rules in the newly created SEC.[51] While the SEC “has no direct power to regulate the level and structure of CEO pay, the agency does determine what elements of pay are disclosed and how they are disclosed.”[52] Since its creation, the SEC has continually adjusted executive compensation disclosure rules.

For example, just a few years after its creation in 1938, the SEC announced disclosure rules in proxy statements specifically for executives and directors.[53] Then in 1948, the SEC increased tabular disclosure of director and officer compensation by requiring individual disclosure.[54] Less than five years later, the SEC retreated from certain itemized disclosure, instead permitting aggregate disclosure.[55] In 1973, the SEC raised the disclosure threshold from $25,000 to $40,000.[56]

Stock market instability during the 1970s caused corporations to design executive compensation packages that offered more predictable payouts.[57] Accordingly, “companies began relying to a greater extent on shareholder-subsidized perquisites . . . such as low-interest loans, yachts, limousines, corporate jets, club memberships, hunting lodges and corporate retreats at exotic locations.”[58]

B. The SEC Streamlined Compensation Disclosure in 1978

Prompted by perceived excesses of executive pay, President Jimmy Carter spoke out about “three-martini lunch[es],”[59] and the SEC in turn instituted new disclosure requirements. The 1978 amendments were the first major overhaul of pay disclosure since the Great Depression and reflected the increased complexity of executive compensation packages generally.[60] Among the changes, the SEC combined separate requirements into a single caption in Regulation S-K, raised the compensation disclosure threshold from $40,000 to $50,000, added tabular disclosure of compensation forms, and increased the number of named executive officers and directors required in the proxy statement from three to five.[61] Notably for perquisite disclosure, the amendments were the first pronouncement requiring tabular dollar value disclosure of perquisites and narrative disclosure of certain perquisites that represented 10 percent of remuneration, or $25,000.[62]

The SEC’s 1978 amendments enabled the IRS’s enforcement of perquisites as taxable income, thereby “lower[ing] after-tax value of perquisites to the manager . . . and reducing the attractiveness of these benefits.”[63] However, empirical studies conducted after 1978 indicated that the increased tax burden on companies did not result in a lower level of total compensation for executives.[64] Instead, the total level of compensation increased.[65]

C. Continued Disclosure Changes from 1978 to 2006

After 1978, the SEC continued to amend disclosure requirements as executive compensation evolved. For example, in 1980, the Commission required a separate table to disclose pensions.[66] The SEC also eliminated directors from the proxy statement’s disclosure requirement and raised the disclosure threshold again from $50,000 to $60,000.[67] Just five years after requiring perquisite disclosure, the SEC in 1983 moved to reduce compliance burdens on firms, which also reduced company transparency for the IRS.[68] For example, within Regulation S-K, the Commission adopted a perquisite threshold of either 10 percent of the cash compensation reported in the cash column or $25,000 to trigger mandatory disclosure under “other compensation.” In doing so, the SEC’s amendments limited the tabular disclosure of executive compensation and “adopted a primarily narrative approach.”[69]

By the early 1990s, the SEC once again amended executive compensation disclosure requirements, seemingly in reaction to the 1987 market crash and subsequent recession. In 1992, the Commission mandated “formatted tabular disclosure for all forms of compensation covering three years, requir[ed] a compensation committee report and a stock performance graph, and chang[ed] the named executive officers for whom disclosure was required.”[70] Notably, the SEC doubled the perquisite disclosure threshold from $25,000 to $50,000.[71] The SEC also raised the value of individual perquisites that had to be identified in the footnotes, further reducing transparency for shareholders and the IRS.[72] In 1993, the Commission clarified the scope of covered executive officers required in a company’s proxy statement. Under the new rule, the proxy statement had to include anyone who served as CEO during the year as well as anyone who departed that role during the year and would have qualified as one of the company’s four highest-paid executive officers.[73]

D. The SEC Overhauled Perquisite Disclosure in 2006

The last significant change to perquisite disclosure occurred in 2006 in response to a “variety of scandals involving accounting fraud, backdating options, severance pay, and pensions” that plagued the early 2000s.[74] Such scandals heightened media attention on executive perquisites, especially executive air travel.[75] The Wall Street Journal, for example, compared publicly available golf scorecards with flight records and concluded that companies used their jets “as airborne limousines to fly CEOs and other executives to golf dates or to vacation homes where they have golf-club memberships.”[76] In 2006, the Treasurer of North Carolina told the New York Times that an executive’s personal use of the corporate jet was as addictive as “crack cocaine.”[77] Further, a government watchdog told USA Today that claiming security necessitates private air travel for executives “is laughable.”[78] The watchdog also expressed that he “wish[ed] companies would stop trying” to justify air travel because it was “all about convenience and ego.”[79]

Amid this public scrutiny, the SEC made changes to its executive perquisite disclosure rules. The changes increased context to disclosure statements by requiring an “expanded narrative disclosure designed to give investors information about how and why a company arrived at specific executive compensation decisions and policies.”[80] Additionally, the SEC clarified that amendments to perquisite disclosure rules applied to both named executive officers and directors during change-of-control episodes or termination.[81]

Additionally, the SEC reversed its 1992 threshold increase. The SEC reduced the $50,000 threshold for perquisite disclosure established in 1992 because it “[allowed] the omission of too much information that investors may consider material.”[82] Instead, the Commission adopted rules requiring firms to disclose perquisites if their aggregate value exceeded $10,000 and to disclose an individual perquisite “if it [was] valued at the greater of $25,000 or ten percent of total perquisites and other personal benefits.”[83] The Commission further clarified that “[w]here perquisites [were] subject to identification, they must be described in a manner that identifie[d] the particular nature of the benefit received.”[84] The SEC gave as an example that “it is not sufficient to characterize generally as ‘travel and entertainment’ different company-financed benefits, such as clothing, jewelry, artwork, theater tickets and housekeeping services.”[85] The SEC also specifically addressed the required disclosure of tax “gross-ups” or “other reimbursement of taxes owed with respect to any compensation, including but not limited to perquisites and other personal benefits . . . even if the associated perquisites or other personal benefits are eligible for exclusion or would not require identification or footnote.”[86]

To understand the perquisite disclosure and threshold requirements, consider reserved parking within a building’s parking garage. A convenient parking spot is neither “integrally and directly related” to an executive’s ability to do their job, nor is it offered on a nondiscriminatory basis to all employees. Therefore, it’s most likely a perquisite. If the cost of the parking, combined with the value of all other perquisites, falls below $10,000, then the company does not have to disclose any of the perquisites given to the executive. However, if the aggregate value of perquisites exceeds $10,000, then the cost of parking must be included. Moreover, if the parking alone exceeds either $25,000 or 10 percent of the aggregate value of perquisites provided to the executive, then the parking must be identified and quantified in the footnotes.[87]

Instead of clearly defining perquisites, in 2006 the SEC issued “interpretive guidance” on how to characterize an expense as a perquisite.[88] For decades, the SEC refused to adopt a bright-line definition of a perquisite for the purposes of Regulation S-K.[89] In 2006, the SEC addressed this decision by expressing concern that if it adopted a bright-line definition, firms would characterize personal benefits in an attempt to circumvent it.[90] The SEC also noted that “it is not appropriate for Item 402 to define perquisites or personal benefits, given that different forms of these items continue to develop, and thus a definition would become outdated.”[91]

The SEC’s reluctance to define perquisites was prescient. For example, 49 percent of respondents to a 1998 survey listed “mobile car telephone” as a perquisite offered to their executives.[92] Today, providing cellphones to all firm employees—not just executives—is common practice. The COVID-19 pandemic also significantly changed what may count as a perquisite in a relatively short period of time, as discussed in Section II.E.

Despite the pace of advancements impacting perquisites, the SEC’s 2006 amendments defining perquisites remain the standard today. The SEC holds that “an item is not a perquisite or personal benefit if it is integrally and directly related to the performance of the executive’s duties”[93] or if the executive has fully reimbursed the company for it. An item is a perquisite if it “confers a direct or indirect benefit that has a personal aspect” regardless of whether it’s provided for a business reason “unless it is generally available on a nondiscriminatory basis to all employees.”[94] The SEC suggests a two-pronged approach using these guidelines: if an item is “integrally and directly related” to the executive’s performance, then the analysis ends since it’s not a perquisite.[95] However, the “integrally and directly related” requirement is “narrow”: executives need this item precisely so that they can do their job.[96] If the benefit is not “integrally and directly related” to the ability of an executive to do their job, companies must then analyze whether the item confers a “direct or indirect benefit that has some personal aspect.”[97] If so, and it’s not generally available on a nondiscriminatory basis to all employees, it’s likely a perquisite.

E. Changes to Executive Compensation Generally After 2006

Since 2006, the SEC has made several amendments to executive compensation disclosure that were generally aimed at increasing transparency and streamlining disclosure. For example, in 2009, the SEC required new compensation disclosure and analysis (CD&A) intended to enable investors to understand and analyze board performance, decision-making, and compensation practices.[98] In 2011, following Congress’s passage of the Dodd-Frank Act, the SEC adopted a sweeping reform to executive compensation that included new rules for golden parachute compensation arrangements and mandated independence of each company’s compensation committee.[99] In 2015, the SEC amended Item 402 of Regulation S-K to require the disclosure of the “median of the annual total compensation of all employees” of a firm, excluding the CEO; the total compensation of the firm’s CEO; and “the ratio of the median of the annual total compensation of all employees to the annual total compensation” of the CEO.[100] This “pay ratio disclosure” was for the “general purpose of further facilitating shareholder engagement with executive compensation.”[101]

Regarding perquisites, the SEC in 2020 issued Compliance & Disclosure Interpretation (C&DI) 219.05, which discussed whether benefits provided to executives during the COVID-19 pandemic constituted perquisites.[102] In this guidance, the SEC reiterated that the “two-step analysis articulated by the Commission [in 2006] . . . continues to apply when determining whether an item provided because of the COVID-19 pandemic constitutes a perquisite or personal benefit.”[103] The Commission also provided an example:

In some cases, an item considered a perquisite or personal benefit when provided in the past may not be considered as such when provided as a result of COVID-19. For example, enhanced technology needed to make the NEO’s home his or her primary workplace upon imposition of local stay-at-home orders would generally not be a perquisite or personal benefit because of the integral and direct relationship to the performance of the executive’s duties. On the other hand, items such as new health-related or personal transportation benefits provided to address new risks arising because of COVID-19, if they are not integrally and directly related to the performance of the executive’s duties, may be perquisites or personal benefits even if the company would not have provided the benefit but for the COVID-19 pandemic, unless they are generally available to all employees.[104]

In early 2022, the SEC also reopened the comment period for its 2015 pay versus performance proposal.[105] The proposed amendment to Item 402 of Regulation S-K would require registrants “to disclose in a clear manner the relationship between executive compensation actually paid and the financial performance of the registrant.”[106] Even though perquisites may vary with company performance, the SEC states in its proposal that perquisites “may be important to consider in order to understand how sensitive the totality of compensation is to performance.”[107] The SEC also welcomed comments on whether this proposal would “facilitate shareholders’ evaluation of a registrant’s executive compensation practices”[108] and “[w]hat effect . . . the proposed amendments [would] have on competition.”[109] Often, perquisites granted to executives have no relationship to company performance, so this proposed amendment might provide another incentive for firms to restructure perquisites.

Despite the various scrutiny from regulators and the media generally, companies are still willing to justify granting robust perquisite packages.[110] In fact, “despite greater shareholder focus on executive pay practices, enhanced SEC disclosures rules and the increased influence of corporate governance groups, the executive benefits and perquisites landscape has held mostly steady over the last 10 years.”[111] As the next section demonstrates, the 2006 amendments and their lenient enforcement leaves shareholders and investors in the dark.

III. Review of Recent Perquisite Disclosures

The current disclosure rules permit companies to obfuscate the actual amount of perquisites given to their executives. The SEC’s current rules neither require independent tabular disclosure of perquisites nor robust narrative descriptions in the footnotes in Item 402 of Regulation S-K. Notably, under the SEC’s current policy, companies do not have to disclose the value of individual perquisites if the value is less than $25,000 or 10 percent of the total value of perquisites.[112] Therefore, if perquisites fall short of these thresholds, potential investors and shareholders cannot calculate the value of perquisites NEOs receive because the aggregate value of perquisites is lumped in with other compensation in the “All Other Compensation” column of the Summary Compensation Table as permitted under Item 402.[113]

Reviewing proxy statements of large domestic companies reveals the disclosure rules’ deficiencies. For example, the Centene Corporation disclosed that it gave $399,986 to its CEO, Michael F. Neidorff, in 2021 under the “All Other Compensation” column.[114] In the footnotes, Centene wrote that “[a]ll other compensation for Mr. Neidorff includes $81,735 of personal use of [c]ompany provided aircraft.”[115] The footnotes also detailed that “[t]he other amounts in other compensation for Mr. Neidorff include[d] $146,500 in life insurance benefits, $126,300 in nonqualified deferred compensation match, $8,700 in 401(k) match, security services, tax preparation and financial advisor fees, Company entertainment event tickets, and life insurance benefits.”[116] Using this example, a shareholder of Centene cannot ascertain how much was spent on, for example, event tickets for Neidorff.

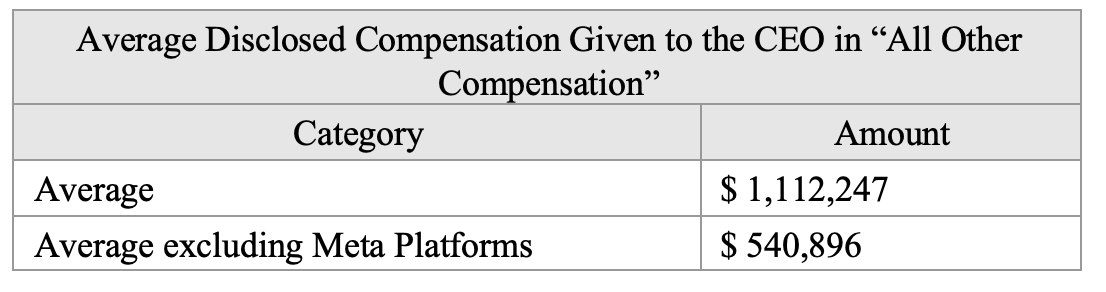

Nevertheless, the “All Other Compensation” column remains one of the best tools an outsider must understand the value of paid perquisites. The following chart summarizes the average total of disclosed compensation in the “All Other Compensation” column compiled from a sample of 2022 proxy statements.[117] The average was calculated with and without Meta Platforms, as its expenditure on CEO Mark Zuckerberg was an outlier. Meta Platforms disclosed that $26,823,060 was given to Zuckerberg under “All Other Compensation,” while the next highest value was Alphabet, which gave its CEO Sundar Pichai $4,322,599 under “All Other Compensation.”[118]

The disclosed perquisites within the “All Other Compensation” column show several trends. More than half the analyzed companies specifically disclosed how much money they spent on the CEO’s use of the company aircraft for personal reasons or on family members. In another survey published by Harvard Law School’s Forum on Social Governance, 83 out of the 100 companies studied permitted personal use of the corporate aircraft by a company’s NEO.[119] This is a marked increase from just a few decades ago. In a survey published in 1999, only 15 percent, 17 percent, and 18 percent of companies offered its NEOs this perquisite in 1998, 1996, and 1994 respectively.[120] A higher percentage of companies might be granting executives this perquisite because of safety concerns. In fact, many companies explain personal use of corporate aircraft by citing board-mandated security policies. For example, Apple claimed in its 2022 proxy statement that “[f]or security and efficiency purposes, Mr. Cook is provided personal security services and is required by the Board to use private aircraft for all business and personal travel.”[121] Similarly, in its 2022 proxy statement, McKesson claimed that “security and safety is integral to the Company’s operations and continued value creation for our shareholders. Our Executive Officer Security Policy requires our CEO to use a corporate aircraft for both business and personal use.”[122]

Such narration is likely included because personal use of corporate aircraft is often the most expensive perquisite given to a CEO. The following charts summarize the highest valued disclosed perquisites and the average cost to the company for the CEO’s personal use of the corporate aircraft.[123]

Another perquisite that was frequently the highest valued was security. However, “security” differed between companies. For example, McKesson categorized its CEO’s use of the corporate aircraft for personal reasons and installation of home security devices under the “security policy” benefit.[124] ExxonMobil, however, did not include personal use of the corporate aircraft as a security benefit.[125] ExxonMobil also included in its proxy statement a relatively lengthy discussion qualifying the need for security claiming:

[p]ersonal security for the CEO, other Named Executive Officers, and other employees is aligned with the intent of the Company’s security program to help employees securely and safely conduct business. The Company does not consider such security costs to be personal benefits because they arise from the nature of the employee’s employment by the Company. However, disclosure regulations require certain security costs to be reported as personal benefits.

The amounts shown in the table include the following types of security-related costs: security systems at executive residences; security services and personnel (at residences and/or during personal travel); car and personal security driver; and Company communications equipment. Security costs related to travel for business purposes are not included.[126]

Meta Platforms gained media attention in early 2022 for its high expenditures on personal security for its CEO Mark Zuckerberg.[127] The company spent more than $15.2 million in 2021 for expenses related to protecting Zuckerberg during his personal travel and while in his homes.[128] The company spent another $10 million on a tax gross-up for this perquisite and $1.6 million on a private aircraft for his personal travel.[129]

Other companies did not disclose any perquisites given to their CEOs. Many claimed that “[p]erquisites received by each other named executive in 2021 did not exceed $10,000 in the aggregate and thus are not included . . . , as permitted under SEC rules.”[130] However, without mandatory disclosure of all perquisites and emphasis on adequate internal policies characterizing them, companies may continue to intentionally under-report or under-count perquisites. The SEC’s recent enforcement actions against companies who disclose little to no perquisites emphasize this loophole, which the SEC could close by amending its rules.

IV. SEC Perquisite Enforcement Actions Since 2018

Even though the SEC hasn’t significantly amended its executive perquisite rules since 2006, it has used its enforcement arm to signal its focus on undisclosed perquisites. In fact, the recent frequency of its enforcement actions has spawned many press releases warning companies to reconsider their perquisite disclosure procedures.[131] Despite increased SEC scrutiny, however, perquisites remain comfortably hidden from meaningful shareholder review behind faulty internal controls and processes.

A. Notable Enforcement Actions Since 2018

Hilton Worldwide Holdings Incorporated: In September of 2020, the SEC settled an enforcement action against one of the largest hospitality companies in the United States, Hilton Worldwide Holdings (Hilton).[132] The SEC found that Hilton failed to disclose around $1.7 million dollars worth of travel and personal perquisites paid to its CEO, President, and other NEOs. The undisclosed perquisites included the personal use of Hilton’s corporate aircraft, hotel stays, and tax gross-ups.[133] The SEC found that Hilton’s internal procedures for identifying, tracking, and calculating perquisites applied the wrong standard that improperly relied on a “business purpose.”[134] Because Hilton undertook “remedial acts promptly,” the SEC ordered just a cease and desist from future violations and a penalty of $600,000—not even half of the amount of undisclosed perks that the SEC discovered.[135]

Argo Group International Holdings: In June of 2020, the SEC settled an enforcement action against an international underwriter of insurance products, Argo Group International Holdings (Argo).[136] The SEC found that Argo failed to disclose over $5.3 million worth of perquisites paid to its CEO, Mark E. Watson III.[137] The undisclosed perquisites included “personal use of corporate aircraft, rent and other housing costs, personal use of corporate automobiles, helicopter trips, other personal travel costs, use of a car service by family members, club and concierge service memberships, tickets and transportation to sporting, fashion or other entertainment events, personal services provided by Argo employees, and watercraft-related costs.”[138] The disclosed perquisites were markedly less controversial and predominately consisted of “401(k) and retirement contributions, the imputed value of insurance coverage, supplemental executive retirement plan benefits, housing and home leave allowances, [and] medical premiums and financial planning services.”[139]

Argo’s internal controls for recording perquisite compensation were also insufficient. For example, Watson categorized his own expenses and approved them for reimbursement.[140] Moreover, Argo did not have processes to track Watson’s personal trips on the corporate aircraft.[141] The board even received notice from a shareholder about Watson’s alleged misuse of company assets in February of 2019, but did not conduct an internal investigation until June of 2019 after receiving a subpoena from the SEC.[142] After reviewing Argo’s remedial efforts in response to the exposed violations, the SEC imposed a $900,000 penalty, which was again less than the amount of undisclosed perks discovered.[143]

RCI Hospitality Holdings, Incorporated: In September of 2020, the SEC settled its enforcement action against the holding company of live-adult entertainment clubs, military-themed “Bombshells” restaurants, and a media group serving the adult nightclub industry, RCI Hospitality Holdings, Incorporated (RCI).[144] Despite stating that they “[do] not provide named executive officers with any significant perquisites” the SEC found $615,000 of nondisclosed perquisite compensation.[145] This perquisite compensation included personal use of the company’s aircraft, company-provided vehicles, personal commercial airline tickets, a housing allowance, a meal allowance, charitable donations, and event tickets.[146] Additionally, perquisite compensation for the CEO included $106,380 for his girlfriend’s salary, who “operated as a personal assistant.”[147] The CFO even knew of this payroll expense and of private tuition payments for the CEO’s children, but failed to adequately disclose them.[148]

The SEC found that RCI lacked proper procedures to keep “accurate books and records, and lacked sufficient internal accounting controls concerning . . . executive perquisites.”[149] The SEC noted an example of the accounting department reimbursing the CEO for a private jet trip that his girlfriend took to New York to visit him on Valentine’s Day.[150] In response to the SEC’s findings, RCI undertook “remedial acts” that included engaging experts to investigate, revise, and implement new internal controls concerning perquisites.[151] In response, the SEC imposed a $400,000 penalty against the company, a $200,00 penalty against the CEO, and a $35,000 civil penalty against the CFO—again, a penalty lower than the total of undisclosed perks.[152]

Gulfport Energy Corporation: In February of 2021, the SEC settled its enforcement action against an American natural gas and crude oil acquirer and producer, Gulfport Energy Corporation (Gulfport).[153] The SEC found that Gulfport failed to disclose around $650,000 in perquisites paid to its CEO, Michael G. Moore, including personal use of the corporate aircraft and interest-free credit for personal expenses on Gulfport’s corporate credit card.[154]

The SEC found Gulfport’s internal controls insufficient. In fact, Gulfport “did not have any internal policies or procedures specifically governing the use of chartered aircraft.”[155] Gulfport did not even review Moore’s aircraft usage to assess whether it was a perquisite and had to be disclosed.[156] For example, Moore chartered Gulfport’s jet for himself and his wife to attend a “wine tasting weekend in Napa, California and a poker tournament in Las Vegas, Nevada.”[157] Because neither of those trips were “integrally and directly related to Moore’s duties as Gulfport’s CEO,” the related expenses should have been reported as perquisite compensation.[158]

Moore also used the corporate credit card to extend interest-free credit at the company’s expense. In 2016, Moore charged over $450,000 in personal expenses to the corporate card, including over $46,000 in one month to pay for hotel charges associated with his son’s wedding.[159] Gulfport paid off the charges to avoid mounting interest and allowed Moore to defer repayment. The SEC found that “the finance department, along with the former CFO, was aware of this” practice.[160] An internal whistleblower alerted Gulfport’s board to Moore’s corporate aircraft and credit card use.[161] In response, the board conducted an internal review and Moore resigned.[162] The company also initiated other remedial efforts to ensure proper internal controls and procedures.[163] In response, the SEC imposed no civil penalties against Gulfport, despite its shocking lack of internal processes before the enforcement action.[164]

National Beverage Corporation: In August of 2021, the SEC settled its enforcement action against National Beverage Corporation (NBC),[165] an American beverage company operating with revenues that exceed a billion dollars.[166] The SEC found that NBC did not adequately “evaluate and disclose certain executive perquisites” related to the CEO’s use of the corporate aircraft.[167] Unlike previous settlements, the SEC did not disclose the name of NBC’s CEO in the published settlement. Despite NBC’s claim that it did not provide “any additional perquisites to Executive Officers, other than a car allowance,”[168] the CEO took chartered personal trips to “domestic and foreign destinations [including] five trips in fiscal year 2016, eight in fiscal year 2017, seven in fiscal year 2018, six in fiscal year 2019, and seven in fiscal year 2020.”[169] Such trips cost the company “approximately $732,647 during the relevant period.”[170]

Again, the SEC found that NBC did not have the proper procedures or trainings in place to identify and analyze whether flights taken by the CEO should be disclosed as perquisites.[171] Interestingly, the SEC didn’t note any remedial actions undertaken by NBC. Instead, it simply imposed a penalty of $481,920.[172] This is not only less than the value of the undisclosed perquisites, it is also just a drop in the bucket for a company with an annual revenue over $1 billion in the same year.[173]

ProPetro Holding Corporation: In November of 2021, the SEC settled its enforcement action against ProPetro Holding Corporation (ProPetro), an oilfield services and hydraulic fracturing company.[174] The SEC found that ProPetro failed to disclose $428,185 worth of perquisites given to its CEO, Dale Redman, and that he played a role in this disclosure failure.[175] Over the two-year investigatory period, the company failed to disclose $252,896 of charges related to Redman’s personal use of the corporate jet alone.[176] ProPetro did not have a formal policy regulating reimbursement for private aircraft expenses. Instead, Redman approved the expenses and passed them on to accounts payable.[177] Redman and his family members also used ProPetro corporate cards for interest-free personal payments. The CEO also received $47,591 for charity and event tickets.[178] When determining a penalty, the SEC again noted how ProPetro undertook “remedial acts promptly.”[179] In response, the SEC imposed a $195,046 penalty, which is likely insufficient deterrence for a company that reported a revenue of $874.5 million in the same year.[180]

Sito Mobile Ltd.: In 2019, the SEC settled its enforcement action against Sito Mobile Ltd. (Sito),[181] a software company. The SEC found that the CEO charged over $100,000 to his corporate card by disguising them as legitimate business expenses.[182] He paid for family trips, sporting tickets, designer clothes, and resort vacations.[183] Sito’s CFO also failed to properly disclose over $200,000 charged to the company’s credit card “for most of his personal meals, commuting costs, his Netflix and Amazon Prime subscriptions, pet groomers, designer sunglasses, and family vacations.”[184] Sito did not disclose one dollar’s worth of perks or personal benefits in its proxy statements.[185] Recognizing Sito’s “remedial efforts,”[186] the SEC did not impose a civil penalty against the company, CEO, or CFO.[187]

Dow Chemical Company: In 2018, the SEC settled its enforcement action against one of the largest chemical producers in the world, the Dow Chemical Company (Dow).[188] The SEC found that Dow failed to disclose $3 million worth of perquisites to its CEO, resulting in underreporting of 59 percent worth of benefits per year.[189] Dow improperly characterized perquisites as expenses because it improperly applied a “business purpose” standard in its internal assessments and did not properly train the employees responsible for assessing such expenses.[190] After an internal audit and the SEC’s enforcement actions, Dow undertook remedial efforts[191] and the SEC imposed a penalty of $1.75 million.[192] Although the SEC’s penalty may seem high, Dow reported $49.6 billion in revenue in 2018.[193]

The table below lists in reverse chronological order the SEC’s recent enforcement actions and shows the comparative value of undisclosed perquisites and civil penalty imposed in each case.

* Civil penalties may include remuneration for violations in addition to perquisite disclosure.

** In addition to corporate aircraft expenses, Gulfport failed to disclose interest payments on behalf of its CEO, the total of which was not included in the SEC’s enforcement action.

*** The SEC imposed a $400,000 fine against RCI, a $200,000 fine against the CEO, and a $35,000 fine against the CFO.

Despite the attention and resources that the SEC has placed on initiating enforcement actions since 2018, its deficient penalties do not incentivize compliance with disclosure rules. Since the SEC refuses to levy penalties that might prompt deterrence, companies will continue to misreport perquisites to the detriment of investors, shareholders, and the American taxpayer. After all, perquisites are supposed to be taxable income.

B. Trends and Deficiencies in Recent Enforcement Actions

The recent spate of SEC enforcement actions initiated against companies for their failure to disclose executive perquisites is unusual considering that the SEC hasn’t updated its disclosure rules in over fifteen years. Therefore, these settlement actions provide insight into the SEC’s priority for perquisite disclosure and reinforce the need for increased disclosure requirements.

Despite a recent increase in enforcement actions, the SEC’s penalties have been woefully inadequate. In fact, of the previously discussed enforcement actions, not a single company received a civil penalty greater than, or even equal to, the value of the undisclosed perquisite disclosures. In the SEC enforcement actions since 2020, the average civil penalty represented only 38 percent of the total undisclosed perquisite disclosure, with a range from 0 percent to 67 percent.

The SEC seems abundantly willing to lessen or eliminate penalties if companies undertake “remedial acts.” One law firm called this trend “beneficial” for publicly traded companies “even in the age of aggressive enforcement” because “cooperation” can “quickly could open a path to a beneficial resolution.”[194] The SEC’s reliance on remedial efforts, however, does not encourage companies to proactively seek out deficiencies in their internal controls or processes. Coupled with the relatively low civil penalties, the SEC’s settlements signal that it’s sufficient for companies to fix problems rather than anticipate and prevent them.

The SEC also failed to uniformly punish those who contributed to the perquisite violations. For example, with RCI Holdings, the SEC fined the CEO, Eric Langan, $200,000 for his role in misreporting perquisites, but Langan remains the Chairman of the board, Chief Executive Officer, and President of RCI Holdings.[195] In the action against NBC, the SEC did not even name the CEO who likely contributed to the misreporting in its settlement. Additionally, the SEC did not uniformly penalize at-fault executives. In Gulfport, the SEC agreed not to impose a civil penalty after, among other remedial measures, its CEO resigned. In Argo, however, the SEC permitted the CFO to remain, despite his role in rubberstamping the CEO’s expense reimbursements.

The enforcement actions also reveal the SEC’s priority of enforcing disclosure of personal aircraft use by NEOs. This might signal two problematic conclusions. First, companies might infer that it is sufficient to only reform internal processes related to personal use of the corporate aircraft knowing that corporate aircraft use is a common target of SEC enforcement. Second, companies might be disincentivized from ensuring proper disclosure of other perquisites. Without a costly and controversial perquisite, like personal use of the corporate aircraft, to cite in settlement negotiations, the SEC may be unwilling to expend its resources investigating other perquisite misclassifications.

Despite the patterns between the previously discussed enforcement actions, these cases are often heavily negotiated and may settle for a myriad of reasons. Hypothetically, a younger CEO may be particularly keen on removing their name from a settlement to mitigate consequences on their career. Or, if an executive has an indemnification clause and therefore doesn’t risk any personal financial peril, they may be unwilling to settle quickly. On the other hand, a company may be incentivized to settle quickly since facts can be salacious and deeply unpopular with shareholders who will resent company-paid trips to poker tournaments[196] or a salary paid to the CEO’s girlfriend for performing personal tasks.[197] As the limited accountability imposed by recent SEC enforcement actions indicates, companies currently have little incentive to curb excessive executive perquisites or disclose those perks.

V. Proposed Amendments to Increase Transparency and Close the Executive Compensation Loophole

The recent enforcement actions demonstrate that the SEC must update its perquisite disclosure rules to prevent companies from hiding millions of dollars from public scrutiny. As written, the rules make room for noncompliance and deficient internal controls, breeding malpractice. In addition, investors and shareholders are not positioned to enforce or police noncompliance because of large information asymmetries and procedural hurdles.

First, shareholders are not positioned to suspect noncompliance. Therefore, they have limited opportunities to even file a claim. As outsiders, they have limited access to credit card statements, flight records, travel details, or accounting statements of an NEO that might raise suspicion. Therefore, noncompliance may persist for years unless a whistleblower or internal employee alerts the proper body.[198] Second, courts are very deferential to a board’s compensation decisions as long as they are disinterested, informed, and do not consciously disregard their responsibilities.[199] For example, the Delaware Chancery Court held that providing a $140 million severance package to a terminated CEO of The Walt Disney Company, who worked for just over a year, did not constitute a claim against the board.[200] There are also procedural challenges inhibiting a shareholder’s ability to even challenge compensation decisions. Usually, shareholders must make a demand to the board before being able to proceed with their claim, which the board can decide whether to move forward with shareholder’s claim.[201]

Even if a shareholder or investor passes these initial hurdles, the burden of proving liability under state or federal law is arduous. Companies may effectively shift the blame for the failed perquisite disclosure. First, the executives who receive the benefits are often not the ones responsible for characterizing them as expenses or perquisites for disclosure purposes—this task falls to other, largely nonexecutive employees. Second, those who are responsible for making expense-classification decisions are often teams of people within the finance and legal departments. Outside counsel and auditors may also have had a hand in assessing and analyzing disclosures, thus further complicating this process. And, because the SEC has not provided a bright-line definition on what a perquisite is, there are legitimate arguments for why a company did or did not disclose a particular business expense as a perquisite and how the company calculated its value. Therefore, shareholders may forgo litigation because legal costs may be higher than the value of the undisclosed perquisite to both the company and the shareholders.

Since shareholders and outsiders face large barriers to bringing executive perquisite disclosure claims and companies can effectively shift responsibility for noncompliance, the SEC must amend its 2006 perquisite disclosure rules and increase penalties for companies that violate them.

A. Proposal 1: Eliminate the $10,000 Perquisite Disclosure Threshold

First, the SEC should eliminate the disclosure threshold that permits companies to not report perquisite compensation if their aggregate value falls below $10,000 by amending 17 C.F.R. § 229.402 (Item 402).[202] Instead, the SEC should require disclosure of the aggregate amount of all executive perquisites paid to NEOs. When the SEC reduced the threshold in its 2006 amendments from $50,000 to $10,000, it noted that the previous threshold omitted “too much information that investors may consider material.”[203] However, the SEC kept a threshold in place because it balanced an investor’s need for total disclosure and the burden on a company to track every benefit.[204] This latter concern contradicts the SEC’s current reliance on proper procedures for tracking and characterizing perquisites, as illustrated in recent enforcement actions. Counterintuitively, the SEC’s 2006 amendment permits companies to not “track every benefit.”[205] Therefore, to ensure that companies proactively establish sufficient procedures that supports compliance, the SEC should eliminate the threshold rule that encourages incomplete tracking procedures.

Admittedly, the SEC was likely concerned with overly burdensome compliance costs while drafting the 2006 amendments.[206] However, such burdens have significantly decreased thanks to increasingly sophisticated and user-friendly business expense tracking software. Eliminating the threshold will force companies to track executive expenses more robustly, which will likely have a positive impact on the overall transparency of executive compensation disclosure.

B. Proposal 2: Require Itemized Disclosure of Perquisites

Next, the SEC should further amend 17 C.F.R. § 229.404 (Item 402) to require itemized disclosure of perquisite compensation. Since the SEC currently permits companies to report perquisites in the “All Other Compensation” column, companies can obscure the amount of personal benefits companies pay to their executives.[207] For example, compensation reported in the “All Other Compensation” column may include: perquisites, security registration costs, amounts paid or accrued in connection with a plan or arrangement such as a change in control, contributions to plans such as retirement accounts, or certain dividends or earnings on stock or options awards.[208] Therefore, it’s nearly impossible to ascertain exactly how much perquisite compensation was paid to an NEO.

In its 2006 amendments, the SEC addressed commentators’ request for a separate supplemental table for perquisites[209] by simply “encourag[ing]” companies to use “additional tables wherever tabular presentation facilitates clearer, more concise disclosure.”[210] Ironically, additional tabular disclosure would almost always yield more concise disclosure. Unsurprisingly, most companies obfuscate perquisite information in the footnotes, instead of creating clear and concise tabular disclosures. For example, companies such as Amazon characterize controversial executive perquisites, like personal use of corporate aircraft, with less controversial descriptions, like personal security, in the footnotes.[211] As previously mentioned, Alphabet paid its CEO over $4 million in perquisites for “personal security.”[212] Alphabet then hid the explanation of what “personal security” might include on another page of its proxy statement.[213] Though the explanation is lacking, Alphabet said: “In 2021, we paid for personal security for Sundar, and incremental costs related to the personal use of non-commercial aircraft . . . [and] named executive officers and their guests may use company aircraft with appropriate approvals and pay tax on any associated imputed income.”[214] It’s wholly unclear how much of the $4 million was spent on personal use of the corporate aircraft or, for example, video monitoring of his home. Therefore, the SEC should discourage misleading characterizations by requiring a tabular breakdown of perquisites in Item 402 delineating the amount of money spent on perquisites apart from other expenditures. Namely, the SEC should require specific disclosure of personal corporate aircraft use.

Several companies employ similar disclosure methods already. For example, ExxonMobil’s 2022 proxy statement included a tabular disclosure listing the amounts included in the “All Other Compensation” column.[215] The columns include “Life Insurance ($),” “Savings Plan ($),” “Personal Security ($),” “Personal Use of Company Aircraft ($),” “Financial Planning ($).” “Relocation ($),” and “Total ($).”[216] Moreover, each category had a subsequent description underneath the chart explaining the nature of the perquisite and how it was calculated. For example, ExxonMobil describes the NEOs aircraft use as:

For security reasons, the Board requires the Chairman and CEO to use the Company aircraft for both business and personal travel. The Compensation Committee considers these costs to be necessary security-related business expenses rather than perquisites. Per the disclosure regulations, the incremental cost of aircraft usage for personal travel is reported. [¶] Incremental cost for personal use of the aircraft is based on direct operating costs (fuel, airport fees, incremental pilot costs, etc.) and does not include capital costs of the aircraft since the Company already incurs these costs for business purposes.[217]

Increased disclosure will also encourage companies to bolster their internal reporting processes. As previously mentioned, many of the recent SEC enforcement actions focused on a company’s insufficient processes to track and characterize perquisites. Requiring greater specificity in periodic financial filings will proactively encourage companies to evaluate their processes, instead of relying on the threat of litigation to improve disclosure. While companies might maintain that requiring categorical disclosure unreasonably increases administrative burdens, companies should be maintaining records of a company’s expenditures already. Moreover, expense tracking software has become more widely available and user-friendly since 2006. This improvement has significantly reduced the administrative burden that the SEC noted in 2006.

The SEC should also expand its narrative disclosure requirements. Such contextualization will help investors and shareholders stay informed about the personal benefits of its executives and their relationship to purported corporate priorities. For example, investors might be interested in how expenditures align with a company’s environmental, social, and governance (ESG) goals.[218] In its 2022 proxy statement, Amazon explained that the $1.6 million paid to its CEO, Jeffrey Bezos, in executive perquisites for “security arrangements” and “business travel” was “reasonable and necessary and for the Company’s benefit, and that the amount of reported security expenses for Mr. Bezos is especially reasonable in light of his low salary and the fact that he has never received any stock-based compensation.”[219] However, Amazon also released a Sustainability Report in 2020 and claimed that they “are committed to building a sustainable business for our employees, customers, and communities. We are driving toward a net-zero carbon future where the people that support our entire value chain are treated with dignity and respect.”[220] Amazon should have to qualify how paying for private chartered flights in the name of “security” contributes towards a “sustainable business for our employees” towards a “net-zero carbon future.” Such narration would complement the SEC’s recently proposed rule in the Spring of 2022 requiring “registrants to provide certain climate-related information in their registration statements and annual reports.”[221]

C. Proposal 3: Increase Penalties for Perquisite Disclosure Violations

Assuming that regulated companies act rationally, they will comply with disclosure rules if the expected penalty for the violation is greater than the cost of compliance.[222] Accordingly, violations will persist if the gain from the nondisclosure exceeds the civil penalty.[223] Here, the civil penalties imposed on noncompliant companies in the SEC’s recent enforcement actions were insufficient to deter future wrongdoing because the violation cost was so low. There may be an added incentive to improperly characterize expenses as perquisites: business expenses may be tax deductible, but perquisites are not.[224] And, since executive perquisites can be large, the potential tax liability may be substantial. Alarmingly, the settlement actions did not indicate that companies were sufficiently penalized for improperly redeeming tax benefits from their noncompliance with executive perquisite disclosure. Therefore, at a minimum, the SEC must increase the civil penalty imposed on companies that fail to disclose perquisites properly.

Even if companies improve their internal reporting processes and systems, insufficient disclosure may still result from inaccurate descriptions or missing information from NEOs. Therefore, the SEC must also increase penalties on executives found to have materially impacted the company’s ability to report its executive perquisite expenditures accurately. For example, the SEC never named NBC’s CEO in its settlement action with the company, likely a concession made during negotiation.[225] The SEC, however, should not permit CEOs to avoid increased scrutiny when their company did not adequately train employees to track and analyze perquisites. With Sito, the CEO disguised over $100,000 of personal charges as business expenses on his corporate card.[226] But, the SEC did not penalize him or the company.[227] At a minimum, if the SEC finds an NEO sufficiently responsible for a disclosure violation, the SEC should require a change in personnel and impose a civil penalty.

Together, the proposed changes of removing the disclosure threshold, increasing tabular disclosure of perquisites, and increasing monetary and employment penalties for disclosure violations will significantly improve shareholders’ and investors’ ability to monitor and hold companies accountable for their executive perquisite practices.

Conclusion

Despite the increased scrutiny on executive compensation, the SEC still permits companies to hide significant executive compensation from investors, shareholders, and the public through its lax executive prerequisite regulation. Such expenditures are not directly related to an executive’s job or performance. While the SEC increased disclosure requirements in 2006, companies continue to skirt them and obscure the actual value of the compensation paid to their executives. Shareholders have little recourse to hold companies accountable and the SEC refuses to apply consistent or sufficient penalties for inaccurate disclosure. Accordingly, the SEC should adopt additional amendments to Item 402 that encourage companies to proactively improve their internal processes to support accurate disclosure and increase transparency in financial reporting documents. Spotlighting executive perquisite disclosure will reduce inappropriate practices that many companies currently engage in and allow investors to hold companies accountable.

Footnotes

[1]. Benjamin Mullin & Theo Francis, Discovery CEO Received $246 Million in Compensation in 2021, Including Big Options Grant, Wall St. J. (Mar. 14, 2022), https://www.wsj.com/articles/discovery-ceo-received-246-million-in-compensation-in-2021-including-big-options-grant-11647295362?mod=article_inline [https://perma.cc/83FN-VA8Z].

[2]. See Discovery, Definitive Proxy Statement (Schedule 14-A) 57 (2022), https://www.sec.gov/Archives/edgar/data/1437107/000120677422000691/disca3983581-def14a.htm [https://perma.cc/K6LX-F29V] (detailing how this compensation includes $774,688 for Zaslav’s personal use of aircraft, including family travel for which Discovery did not provide Zaslav a tax gross-up and $38,763 for tax gross-ups for business associate and spouse travel).

[3]. See id.

[4]. Nellie Andreeva & Peter White, The Dish: Warner Bros. Discovery Braces for New Round of Layoffs This Week, Deadline (Oct. 10, 2022), https://deadline.com/2022/10/warner-bros-discovery-layoffs-warner-bros-television-group-1235140339/ [https://perma.cc/4LDT-K48L].

[5]. See Mullin & Francis, supra note 1.

[6]. Apple, Definitive Proxy Statement (Schedule 14-A) 51 (Mar. 4, 2022) https://www.sec.gov/Archives/edgar/data/320193/000119312522003583/d222670ddef14a.htm [https://perma.cc/HQB3-WBNN].

[7]. See Mitchell Clark, The Tech Industry’s Moment of Reckoning: Layoffs and Hiring Freezes, Verge (Jan. 4, 2023), https://www.theverge.com/2022/11/14/23458204/meta-twitter-amazon-apple-layoffs-hiring-freezes-latest-tech-industry [https://perma.cc/MK6J-ETDL].

[8]. See Mark Anthony Gubagaras & Darakhshan Nazir, Alphabet Retains Top Median Employee Salary, Hits Lowest CEO Pay Gap in Tech, S&P Global (Sept. 6, 2022), https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/alphabet-retains-top-median-employee-salary-hits-lowest-ceo-pay-gap-in-tech-71896693#:~:text=This%20was%20due%20to%20a,salary%20remained%20at%20%242%20million [https://perma.cc/3AH6-XC7E]; see also infra note 14 briefly discussing the shortcomings of the SEC’s pay ratio disclosure rule.

[9]. Alphabet, Definitive Proxy Statement (Schedule 14-A) 51 (Apr. 22, 2022) https://www.sec.gov/Archives/edgar/data/1652044/000130817922000262/lgoog2022_def14a.htm [https://perma.cc/9VAU-BQXZ].

[10]. Id. at 50–51 (“In 2021, we paid for personal security for Sundar, and incremental costs related to the personal use of non-commercial aircraft for Sundar . . . .”).

[11]. Jeffery Dastin, Alphabet Cuts 12,000 Jobs After Pandemic Hiring Spree, Reuters (Jan. 20, 2023), https://www.reuters.com/business/google-parent-lay-off-12000-workers-memo-2023-01-20/ [https://perma.cc/DPH3-AKE3].

[12]. See Jack Kelly, Alphabet Seeks to Identify 10,000 Poor-Performing Googlers as Activist Investor Calls to Cut Staff, Forbes (Nov. 21, 2022), https://www.forbes.com/sites/jackkelly/2022/11/21/alphabet-seeks-to-cut-10000-poor-performing-googlers/?sh=522077f82704 [https://perma.cc/EVW7-VRKV].

[13]. See, e.g., Minor Myers & Justin Sevier, The Paradox of Executive Compensation Regulation, 44 J. Corp. L. 756, 756–63 (2019); Michael C. Jensen & Kevin J. Murphy, CEO Incentives—It’s Not How Much You Pay, but How, Harv. Bus. Rev. (1990), https://hbr.org/1990/05/ceo-incentives-its-not-how-much-you-pay-but-how [https://perma.cc/M5ZH-FSK7].

[14]. Scholars question the effectiveness of the CEO-to-worker pay ratio rule. See, e.g., Wonjae Chang, Michael Dambra, Bryce Schonberger & Inho Suk, Does Sensationalism Affect Executive Compensation? Evidence from Pay Ratio Disclosure Reform, 61 J. Acct. Rsch. 187, 188 (2022) (finding that after U.S. public firms were required to report the ratio of their CEO’s compensation to their median worker’s compensation, little evidence suggests total CEO compensation changed in response to this disclosure rule; instead, boards adjusted the mix of compensation to reduce media scrutiny). Nevertheless, the disclosure requirement “reflects a belief in Congress . . . that CEO pay is excessive and that disclosing the ratio will shame boards into lowering CEO pay.” Kevin J. Murphy & Michael C. Jensen, The Politics of Pay: The Unintended Consequences of Regulating Executive Compensation 3 J.L., Fin. & Acct. 189, 228 (2018).

[15]. Calls for increasing taxes on the nation’s highest earners are frequent. While wealth inequality grows, “centibillionaires like Elon Musk and Jeff Bezos have become ubiquitous celebrities, elevating their exorbitant wealth.” See Paul Constant, The American Appetite to Tax the Rich is High — and Growing with Each Passing Year, Insider (July 23, 2022), https://www.businessinsider.com/why-more-americans-want-tax-rich-2022-7 [https://perma.cc/K3GE-895J]. Exemplifying the recent call for increased taxation on the rich, Senator Elizabeth Warren wrote an op-ed for the New York Times calling to end

tax loopholes for the rich and powerful. About two-thirds of likely American voters — including a majority of Republicans — say it’s time for billionaires to pay more in taxes. Nearly three-quarters of Americans want to put an end to wildly profitable corporations paying nothing or little in federal income taxes (yes, Amazon, I’m looking at you) and put into place a global minimum corporate tax.

Elizabeth Warren, Opinion, Elizabeth Warren: Democrats Can Avoid Disaster in November, N.Y. Times (Apr. 18, 2022), https://www.nytimes.com/2022/04/18/opinion/elizabeth-warren-democrats-biden-midterms.html?smid=tw-share [https://perma.cc/5ZAM-UZDV]. Congresswoman Alexandria Ocasio-Cortez famously wore a “Tax the Rich” dress to the Metropolitan Museum of Art’s Costume Institute benefit gala in New York in 2021 as she publicly pushed for legislation to increase the wealth tax. See Joe Dwinell, AOC Launches ‘Tax the Rich’ Political Merchandise off Met Gala 2021 Dress Controversy, The Mercury News (Sept. 15, 2021), https://www.mercurynews.com/2021/09/15/aoc-launches-tax-the-rich-political-merchandise-off-dress-controversy/ [https://perma.cc/PN-P9MR].

[16]. Recognizing this trend, law firms issued press releases that warned companies of the SEC’s renewed interest in targeting perquisite disclosure. See, e.g., Brandon Len King, Scott Mascianica & Jessica B. Magee, The SEC’s Ears Remain Perked for an Abundance of Executive Perks, Holland & Knight SECond Opinions Blog (Jan. 24, 2022), https://www.hklaw.com/en/insights/publications/2022/01/the-secs-ears-remain-perked-for-an-abundance-of-executive-perks [https://perma.cc/6WKY-R3TJ]. The Harvard Law School Forum on Corporate Governance also published survey results confirming the SEC’s focus on perquisite compliance. See Corporate Governance & Executive Compensation Survey, Harv. L. Sch. F. on Corp. Governance (Dec. 7, 2022), https://corpgov.law.harvard.edu/2022/12/07/corporate-governance-executive-compensation-survey/ [https://perma.cc/UF7Q-5YHX].

[17]. See Corporate Governance & Executive Compensation Survey, supra note 16.

[18]. Gulfport Energy Operating Corp., Exchange Act Release No. 91196, 2021 WL 754895, at *7 (Feb. 24, 2021).

[19]. Id. at *8–9.

[20]. Id.

[21]. See Dow Chem. Comp., Exchange Act Release No. 3947, 2018 WL 2574438 (July 2, 2018). The SEC found that the Dow Chemical Company failed to report around three million dollars’ worth of perquisites paid to its executives during the investigatory period. Id.

[22]. See Ilya Marritz & Andrea Bernstein, Allen Weisselberg, A Trump Org Employee for Decades, Pleads Guilty to Felony Charges, NPR (Aug. 18, 2022), https://www.npr.org/2022/08/18/1117948260/allen-weisselberg-trump-employee-pleads-guilty-felony [https://perma.cc/U7JF-9V7T].

[23]. See id.

[24]. Lauren del Valle, Trump Org. Controller Said He Was Ordered to Hide Benefits on Tax Forms, CNN (Nov. 10, 2022), https://www.cnn.com/2022/11/10/politics/trump-org-trial/index.html [https://perma.cc/PL8T-FN5R].

[25]. Id.

[26]. Id.

[27]. Ben Protess, Jonah E. Bromwich, William K. Rashbaum & Lola Fadulu, Trump’s Company Is Guilty of Tax Fraud, a Blow to the Firm and the Man, N.Y. Times (Dec. 6, 2022), https://www.nytimes.com/2022/12/06/nyregion/trump-org-verdict-guilty.html [https://perma.cc/3UL2-2W5F].

[28]. See Marritz & Bernstein, supra note 22.

[29]. See Lucian Arye Bebchuk, Jesse M. Fried & David I. Walker, Managerial Power and Rent Extraction in the Design of Executive Compensation, 69 U. Chi. L. Rev. 751, 762 (2002) (proposing a “managerial power approach” to study the relationship of executive compensation).

[30]. See NYSE, Listed Company Manual § 303A.05 (Jan. 2004), https://www.sec.gov/rules/sro/nyse/2013/34-68639-ex5.pdf [https://perma.cc/MCJ9-HSJQ]; NASDAQ Listed Company Manual § 5605(d), https://listingcenter.nasdaq.com/rulebook/nasdaq/rules/nasdaq-5600-series [https://perma.cc/4GLH-8JVC]; Item 402(k) of Regulation S-K, 17 C.F.R. § 229.402(k).

[31]. See Treas. Reg. § 1.162–27 (as amended in 2020) https://www.govinfo.gov/content/pkg/CFR-2011-title26-vol2/pdf/CFR-2011-title26-vol2-sec1-162-27.pdf [https://perma.cc/5LKU-JL24].

[32]. SHRM, Designing Executive Compensation Plans, https://www.shrm.org/resourcesandtools/tools-and-samples/toolkits/pages/executivecompensationplans.aspx#:~:text=According%20to%20the%20Center%20on,Performing%20Companies%20Pay%20Executives%20Differently [https://perma.cc/9QDQ-VQR9].

[33]. Id.

[34]. “Economic rent” is often defined as the excess money earned above what is expected or even necessary to maintain the income stream. Economic rent is usually created by market inefficiencies or informational asymmetries. See, e.g., Economic Rent Definition, Merriam-Webster, https://www.merriam-webster.com/dictionary/economic%20rent [https://perma.cc/6M3W-DPJX].

[35]. See Bebchuk, Fried & Walker, supra note 29, at 756 (suggesting that, despite independent compensation committees, “executives . . . have substantial influence over their own pay”); see also Lucian Arye Bebchuk & Christine Jolls, Managerial Value Diversion and Shareholder Wealth, 15 J. L., Econ. & Org. 487, 487–88 (1999) (discussing how executive actions can provide executives “with private benefits that increase the effective level of managerial pay above the level implied by salaries, bonuses, and other forms of direct compensation”).

[36]. See Bebchuk & Jolls, supra note 35, at 488.

[37]. 17 C.F.R. § 229.402(k)(2)(vii)(A) (2007).

[38]. Id. § 229.402 (Item 402).

[39]. There are several methodologies used to calculate the value of perquisites. Such analysis is beyond the scope of this paper. However, the SEC in 17 C.F.R. § 229.402(c)(2)(ix) requires that “the registrant shall describe in the footnote its methodology for computing the aggregate incremental cost.” For example, Amazon’s 2022 Annual Report states that the $1.6 million it paid to its CEO Jeffrey Bezos for security costs “represents the approximate aggregate incremental cost to Amazon.” Amazon, Definitive Proxy Statement (Schedule 14-A) 98 (May 25, 2022) https://www.sec.gov/Archives/edgar/data/1018724/000110465922045572/tm223357-5_def14a.htm [https://perma.cc/3FYB-CCS8].

On the other hand, CVS’s 2021 Annual Report states that:

The Company determines the amount associated with personal use of Company aircraft by calculating the incremental cost to the Company based on the cost of fuel, trip-related maintenance, deadhead flights, crew travel expenses, landing fees, trip-related hangar costs and smaller variable expenses. The Company determines the amount associated with personal use of Company car by calculating the incremental cost to the Company based on mileage, car fees, and driver salary.

CVS, Definitive Proxy Statement (Schedule 14-A) 71 (May 13, 2021) https://www.sec.gov/Archives/edgar/data/64803/000120677421000974/cvs3833491-def14a.htm [https://perma.cc/VB6K-DLWS].

[40]. 17 C.F.R. § 229.402(c)(2)(ix).

[41]. See Corporate Governance & Executive Compensation Survey, supra note 16.